Carrie Webster/iStock via Getty Images

EU Designates Six Tech Giants as Gatekeepers

On September 6, 2023, the EU confirmed six tech giants are subject to the Digital Market Act. The six so-called “gatekeepers” are Alphabet/Google (GOOG) (GOOGL), Amazon (AMZN), Apple Inc. (NASDAQ:AAPL), ByteDance, Meta Platforms (META), and Microsoft (MSFT).

The EU said that these large tech firms, referred to as “gatekeepers,” provide 22 key online services that will fall under the requirements of the new Act. This landmark regulation aims to curb the power of dominant platform companies by promoting more fairness, competition, and transparency across core digital services like search, social media, advertising, app stores, and operating systems.

Apple’s stock was down 3.7% at the time we wrapped the report.

Here is the excerpt from TechCrunch:

Here’s the full breakdown: Four social networks (TikTok, Facebook, Instagram, LinkedIn); six “intermediation” services (Google Maps, Google Play, Google Shopping, Amazon Marketplace, iOS App Store, Meta Marketplace); three ADS, or ads delivery systems (Google, Amazon and Meta); two browsers (Chrome, Safari); three operating systems (Google Android, iOS, Windows PC OS); two N-IICS, or Number-Independent Interpersonal Communication Service in the regulatory jargon, (WhatsApp, Facebook Messenger); one search engine (Google); and one video sharing platform (YouTube).

Expected Impact of the Digital Markets Act

Here is the excerpt from the EU Commission website.

- Business users who depend on gatekeepers to offer their services in the single market will have a fairer business environment.

- Innovators and technology start-ups will have new opportunities to compete and innovate in the online platform environment without having to comply with unfair terms and conditions limiting their development.

- Consumers will have more and better services to choose from, more opportunities to switch their provider if they wish so, direct access to services, and fairer prices.

- Gatekeepers will keep all opportunities to innovate and offer new services. They will simply not be allowed to use unfair practices towards the business users and customers that depend on them to gain an undue advantage.

Potential Impact on Apple’s Services Business

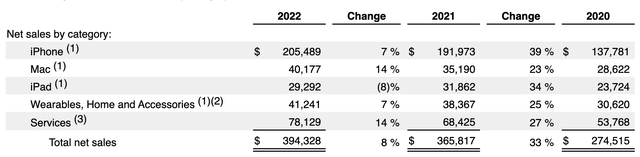

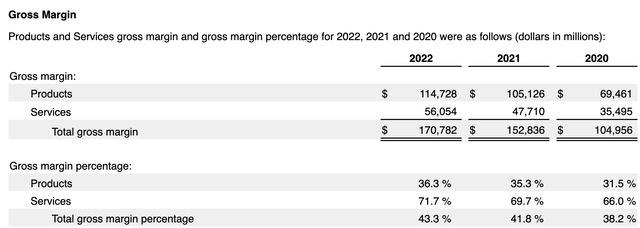

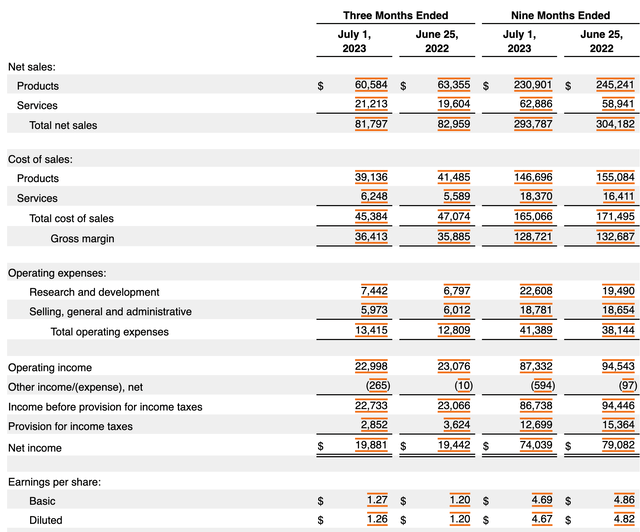

DMA should have an impact on Apple’s service revenue at first glance. Its services net sales account for 20% of total revenues. Services net sales include sales from the Company’s advertising, AppleCare, cloud, digital content, payment, and other services.

However, from a profitability perspective, services revenues account for 33% of gross profits and grew by 20% in 2022, which is much higher than its product sales of 11%.

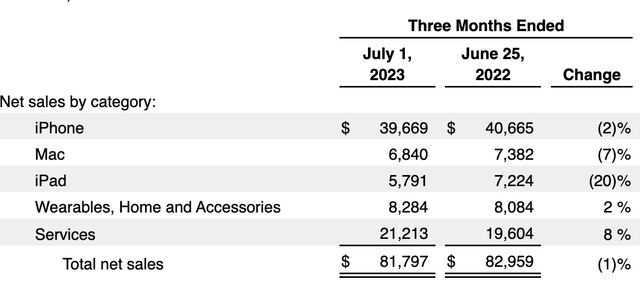

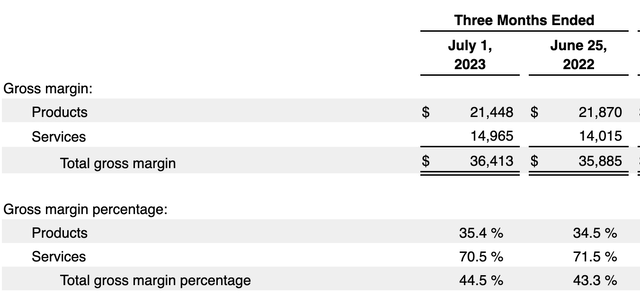

In Q2 2023, the service income ratio further increased as its product sales declined. Service revenue as a percentage of the total increased to 26% and service gross margin as a percentage of the total increased to 38%.

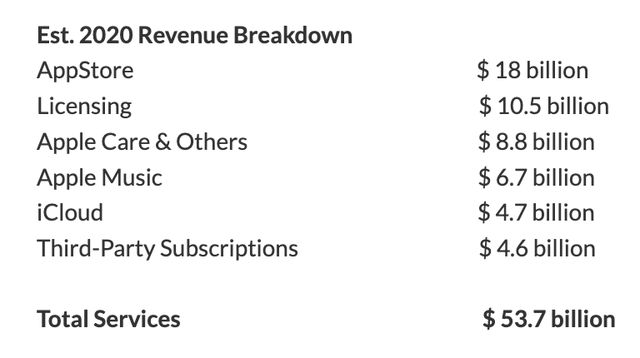

Although the data is a bit outdated, we can still get insight from this source. Based on the estimated service revenue breakdown, the impact of this law covers almost all the service revenue segments:

We expect that The Digital Markets Act is likely to have wide-ranging impacts across Apple’s services business – the App Store may be forced to allow more competition and change its revenue share model, reducing commissions; Apple Music and iCloud could face increased competition and pricing pressure; licensing revenue could drop as Apple has to offer fairer terms; and third party subscriptions on iOS could gain more freedom to operate, potentially altering revenue sharing agreements with Apple. Overall, the DMA threatens to weaken Apple’s control and profitability across its services segment by opening up closed ecosystems, creating a more level playing field, and forcing Apple to give up some of its advantages and lucrative business practices. While the specifics remain to be seen, the DMA fundamentally challenges the walled garden approach Apple has relied on to drive service growth.

Valuation

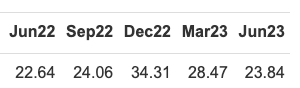

Apple’s stock historically traded at a PEG ratio below 2. It is now trading at 2.78x, which is considered high.

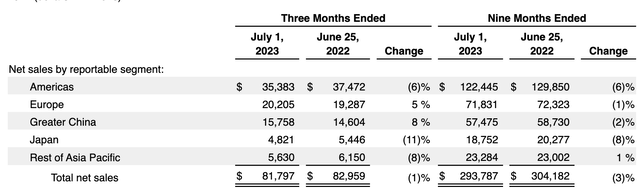

It currently faces challenges in growing product sales as a result of the challenging macro environment. By geography, Americans, account for 43% and Europe accounts for 24% of total revenues.

The slower growth in product sales already put pressure on Apple’s stock as its high PEG ratio is supported by the only growth driver of 15% growth in service revenues in Q2 2023.

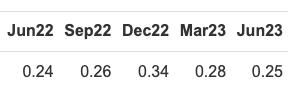

Services Gross Margin Percentage Declining as Bargaining Power Slips

Its Services gross margin percentage decreased during the third quarter of 2023 compared to the third quarter of 2022 due primarily to higher Services costs. This suggested that Apple’s bargaining power against developers is in decline although still very strong. The new law is likely to further give Apple more pressure on gross margin.

Defenses of Cost Cutting and Buybacks Offer Diminishing Returns

While Apple has many defense strategies such as cost-cutting and share buybacks to defend its bottom line, its operating cost optimization defense line is being penetrated. Although it reduced selling, general, and administrative expenses in the quarter, its operating income is still in decline. This suggests its cost efforts are not large enough to protect its bottom line.

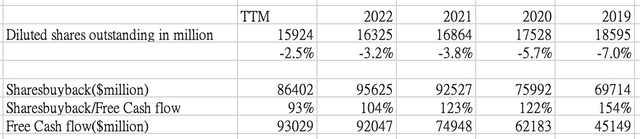

In addition, its share buyback power seems to have plateaued as it has utilized 93% of its free cash flow to fuel the share repurchases. The chart below shows that its diluted share outstanding reduction rate was shrinking from 7% in 2019 to 2.5% in the trailing twelve months.

The reasons are obvious: (1) Its free cash flow, which is predominantly generated by its operations, is slowing as a result of weak product sales and may face more pressure as service revenues are impacted. (2) Its share buyback strategy is getting harder to execute as its stock price has gone up.

In our previous article, “Google: An Antitrust Whale In Tech’s Waters,” we mentioned that regulatory risk for large tech was on the rise. While Apple continues to dominate consumers’ mindset, and a US court ruled a favorable result for Apple in August 2023, we think the pushback from enterprise customers and regulators is likely to impact Apple.

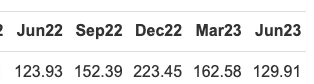

In fact, its ROA, ROE, and asset turnover have already declined substantially over 2 consecutive quarters, while its PEG ratio remains near historical highs. We think the valuation is likely not justified and should offer limited upside for investors.

ROA (GuruFocus) ROE (GuruFocus) Asset turnover (GuruFocus)

Conclusion

Our view is that regulatory risk is increasing for Apple despite its strong brand and loyal customer base. Both Apple’s product segment, including iPhone sales, and its services segment, like the App Store, face growing challenges. On the product side, macroeconomic trends like high inflation and potential recession are hampering consumer demand, especially in key markets like the U.S. and Europe. The services business is likely to face pressure from regulatory actions like the Digital Markets Act that will force Apple to open up its closed ecosystems. Overall, Apple’s growth outlook is dimming.

Apple has historically relied on cost-cutting and massive share buybacks to protect profits when demand falters. However, these defenses appear to be weakening. Recent cost-cutting has not stopped declining operating income, suggesting expenses are not flexible enough. Buybacks are heavily dependent on cash generation, which is slowing. With its stock at historical highs, buybacks also have a diminished impact on the share price. Between slowing core operations and reduced defenses, Apple seems vulnerable to an earnings squeeze.

Despite these risks, Apple’s PEG ratio remains elevated above 2X compared to historical averages below 2X. Typically, such a high multiple requires strong growth, which Apple now lacks. We believe Apple’s premium valuation is overstretched and limits the upside for investors. Until growth stabilizes, regulatory risk is reduced, and valuation contracts, we suggest looking at other assets. Apple Inc.’s upside seems limited in the next 12 months.