Justin Sullivan

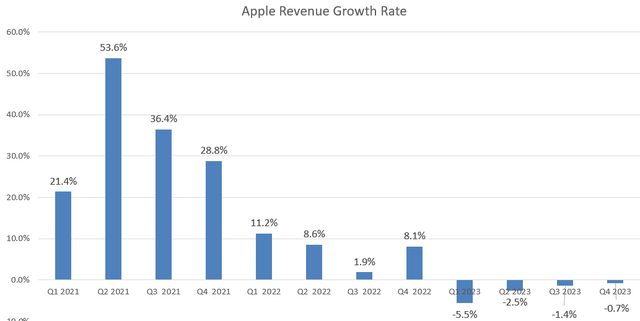

Apple (NASDAQ:AAPL) reported its Q4 FY23 results on November 2nd, 2023. The company experienced a 0.7% decline in revenue year-over-year, with foreign exchange having a negative impact of 2% this quarter. Product revenue decreased by 5% from last year, while service revenue grew by 16% year-over-year. As mentioned in my introductory article, I expect Apple’s service business to continue being a growth driver for the company over the next few years. Therefore, I maintain a “Buy” rating with a new fair value of $200 per share.

Q4 FY23, FY23 Review and Outlook

The 16% year-over-year growth in services offset the weakness in their product declines of 5%, which were challenged by both Mac and iPad sales. Additionally, operating expenses were at the low end of their previous guidance, and diluted earnings per share [EPS] grew by 13% year-over-year.

More specifically, Mac revenue declined by 34% this quarter. During the earnings call, Apple’s management attributed this decline to challenging market conditions and strong comparable from the same quarter last year. Similarly, iPad sales decreased by 10% year-over-year, with the tough comparison this quarter being driven by strong comparable from the previous year. I believe the personal electronics end-market is facing strong headwinds this year, and Apple’s performance can be understood in this context.

Throughout the pandemic, many personal electronics manufacturers were challenged by supply chain disruptions and surges in customer demands. At that time, the supply couldn’t meet the demand. However, starting from last year, the supply chain began to improve, allowing manufacturers to deliver more products to customers and distributors. Consequently, there was an abnormal revenue growth for the industry. Now, demand and supply are becoming normalized and equalized, leading to tough comparisons for these personal electronics manufacturers from last year.

Regarding the PC and tablet markets, IDC forecasts a 3.7% growth in PC shipments and a 4.4% increase in tablet sales in 2024. I believe the overall market is returning to a normal growth rate in the post-pandemic era.

On the balance sheet, Apple ended the quarter with over $162 billion in cash and equivalents and $111 billion in debts, putting them in a net cash position of $51 billion. During the quarter, they returned $25 billion to shareholders through dividends and share buybacks.

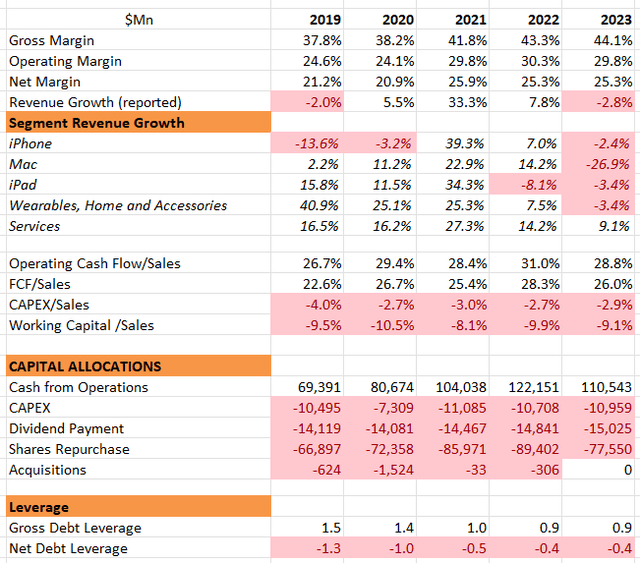

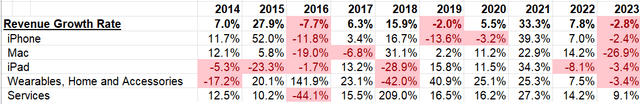

For the full year of FY23, Apple delivered a -2.8% revenue growth, but maintained a very robust balance sheet with net debt leverage at -0.4x. It’s worth noting that despite declining product sales in FY23, service revenue grew by 9.1% compared to FY22, which is remarkable. Services represented 22.2% of the group’s revenue in FY23, marking a significant increase from 15% of total revenue in FY18.

Q1 FY24 Guidance with Strong Gross Margin

Their gross margin stood at 45.2% in the September quarter, marking a very solid result with a 70 basis points sequential expansion. During the earnings call, their management guided the gross margin to be in the range of 45%-46% for Q1 FY24, and operating expenses were expected to be between $14.4 billion and $14.6 billion. This gross margin guidance is notably strong compared to their historical performance.

The high gross margin was attributed to several factors. Firstly, the falling prices of commodities have positively impacted Apple’s product margins. Fluctuations in commodity pricing could affect Apple’s gross margin, and the decrease in prices contributed to the expansion of their gross margin. Secondly, foreign exchange challenges have affected their performance for several quarters. However, the management expressed confidence that foreign exchange headwinds should be easing in the next fiscal year. Lastly, services carry a higher gross margin, so the faster growth of the service business could change the revenue mix, thus expanding the overall gross margin. For instance, their service gross margin was 70.9% in Q4 FY23, significantly higher than the 45.2% at the group level. As illustrated in the table below, their service revenue has clearly been a key growth driver for their overall growth in recent years.

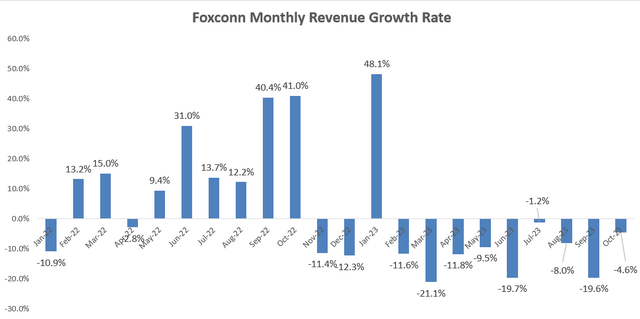

Foxconn Monthly Result

Foxconn (OTCPK:FXCOF) published its October revenue results, showing a 4.6% year-over-year decline. As Apple’s primary contractor for the production of various devices, including iPhones and MacBook laptops, Foxconn’s performance is closely linked to Apple’s product demand. When incorporating Foxconn’s revenue figures from July to September, there was an 11.7% decline in this quarter. This decline underscores the persistent demand pressure for personal electronic products in the near future.

Valuation Updates

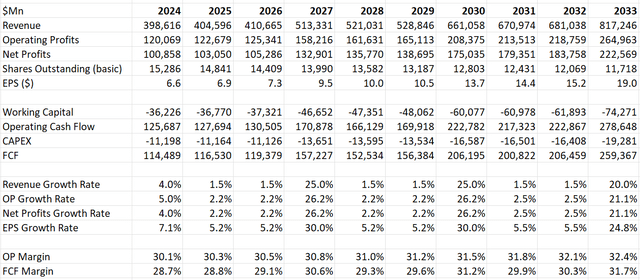

Based on the analysis of the factors discussed earlier, I do not anticipate a robust recovery in both the smartphone and other personal electronics markets in FY24. Consequently, my assumption for Apple’s revenue growth in FY24 is modest, set at 4%. However, I do expect Apple to expand its gross margin and operating margin in the coming years due to falling commodity prices and a shift in the revenue mix towards services.

The model employs similar inputs, including a 10% discount rate, 4% terminal growth rate, and a 16% tax rate. Based on these factors and considerations, my estimated fair value for Apple’s stock price is $200 per share.

Apple DCF – Author’s Calculation

Takeaways

Given the continued momentum in Apple’s service business and its stabilizing effect on the overall group performance, alongside the challenges faced by the personal electronics market in the near future, I maintain my “Buy” rating for Apple. With the new fair value estimated at $200 per share, I believe this reflects the company’s current standing and potential growth in the coming period.