ozgurdonmaz

Apple (NASDAQ:AAPL), now the second-largest company in the world in terms of market cap, is experiencing a rare year of significant underperformance amid a slew of bad news and worries about its future growth prospects.

Let’s make sense of all the noise, tackle every reason for the selloff, and assess whether or not it’s a buying opportunity.

Background

I’ve been covering Apple on Seeking Alpha since April of last year. Throughout the period, I maintained a Buy rating, claiming Apple is quietly building one of the strongest ecosystems in the world. Heading into 2024, it seemed like our thesis was correct and Apple continued to beat the market. Then, bad news started to flow, and as we’ll discuss, I believe that this time, the problems are truly fundamental.

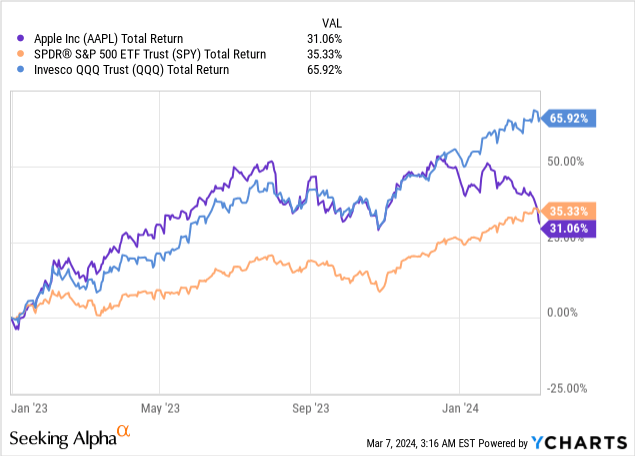

Heading into 2024, investors were worried that there’s little room for upside in the market following a marvelous 2023 for stocks, including Apple. Those fears quickly evaporated as the market has had one of its best starts to a year. However, for Apple, not so much.

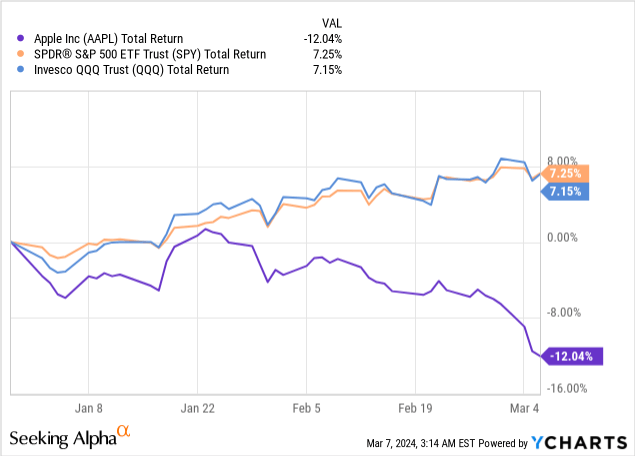

Apple is underperforming both the S&P 500 (SPY) and the Nasdaq 100 (QQQ) by nearly 20% year-to-date, after entering the year as a market leader in 2023.

We can see that right around January 2024 is when Apple’s performance diverged from the QQQ, and the company is now trailing the S&P 500 since the beginning of 2023.

Let’s try to figure out why.

China Slowdown Amid Rising Competition

One of the first pieces of bad news Apple faced in China was the government banning Apple devices for use in several government agencies.

Then, several reports showed China sales dropped 30% in first week of 2024, as Huawei’s return to the market led price-conscious Chinese customers to flee away from the more expensive iPhone.

More recent checks by Counterpoint show iPhone sales in China fell 24%, in the first six weeks of 2024, with Huawei again cited as the major reason. Increased competition is leading Apple and its resellers to discount products at aggressive levels, with some pointing to more than 10% reductions in effective price.

Overall, China, which was a major growth driver for Apple over the last decade as sales in the region grew more than 3x between 2012-2022, is now becoming a drag on the company’s growth, with several quarters of revenue declines.

From a peak of 18.9% of Apple’s total sales in 2023, China sales dropped to 17.4% of sales in Q1’24. Still, China is a very important geography for Apple.

Regulatory Heat & The Recent $2 Billion Fine

Apple is facing a diversified mix of regulatory pressures, some direct and some indirect.

Starting with the recent news about the EU slapping Apple with a $2 billion fine Generally, if you invest in the largest, most successful companies in the world, you should expect regulatory pressures to be a constant theme. However, this is accelerating from a couple of hundred million here and there to now a significant $2 billion fine, which represents more than 2% of Apple’s net income.

In short, Apple is being fined for “abusive” App Store rules against music streaming providers. According to the EU, Apple not allowing such providers to direct users to subscribe from outside the Apple App Store is harming both users and providers, who both need to deal with higher costs to pay the App Store fee.

Another major regulatory pressure is coming not from a direct Apple case, but rather a DOJ case against Google (GOOG). The DOJ maintains that Google paying to be the default search engine across several browsers and devices, including Apple’s Safari, is harming competition. According to estimates, Google pays Apple $18 billion annually in traffic acquisition costs.

Shutting Down The Car Project

According to several reports, Apple’s not-so-secret car project was recently shut down. The project, which was never formally acknowledged by the company, is now over.

Many explanations were offered, including a reallocation of resources into AI and Apple’s inability to achieve a top-level product that is good enough to meet the Apple standard.

The truth is probably a mix of both, with Apple understanding that, just like TVs, it won’t be able to produce a car that could disrupt the highly competitive automotive market, and therefore deciding to cut its losses and invest elsewhere.

Still, the car market is huge, and for a company with almost $400 billion in sales, such a market could have been something that actually moves the needle.

Berkshire Selling Shares

Not as fundamentally significant but still worth mentioning, Apple’s largest shareholder, Warren Buffett’s Berkshire Hathaway, reduced its stake by 1%, selling 10 million shares in Q4’23.

Berkshire owns approximately 10% of Apple, and with Buffett’s large following, if they continue to trim their position, this could be a major drag on the company’s shares.

Enough of the bad news; let’s look ahead.

Will AI Save Apple?

So, Apple investors had little to hold on to during the past months, with bad headline after another. As I wrote in several of my previous articles covering the company, being able to withstand bad headlines is a must if you want to be a long-term Apple shareholder.

However, I do believe that for the first time in a while, there are fundamental problems as well.

With Apple’s hardware upgrade cycles becoming longer and longer, the company can no longer rely on an annual boost in revenues from new releases.

Furthermore, increased competition in China, and fewer true innovations from one generation to the next have led hardware sales to essentially reach a halt (Q1’24 product revenues came in line with Q1’21).

This is being felt on many fronts, with the more recent one being a lack of enthusiasm for new MacBook releases that barely got any attention.

And while some of the poor product performance is being offset by Apple’s services, the latter is increasingly scrutinized by regulation, as we discussed, and it also didn’t have a major moment since the release of Apple Pay.

All of that leads me to one major catalyst – AI. The 2024 buzzword is becoming a very crucial area for Apple, which is yet to have a major release on that front.

Acknowledging expectations on that front, Tim Cook has uncharacteristically said we should expect announcements on this front later this year, with investors pinpointing this year’s WWDC as the prime venue.

Apple has reportedly placed many of its car personnel in AI roles, and is working on a coding companion, as well as AI-driven Apple Music features.

The way I see it, Apple is best positioned to produce a smartphone with true jaw-dropping AI features, including a personal assistant that will be able to do tasks like read, answer, and summarize emails, schedule appointments and make reservations, create music playlists and photo albums, and a whole lot more.

The only questions are when will it be able to launch such technology, and will it be as good as expected because I think it will unquestionably drive a major upgrade cycle and accelerate services growth.

Q1’24 Results

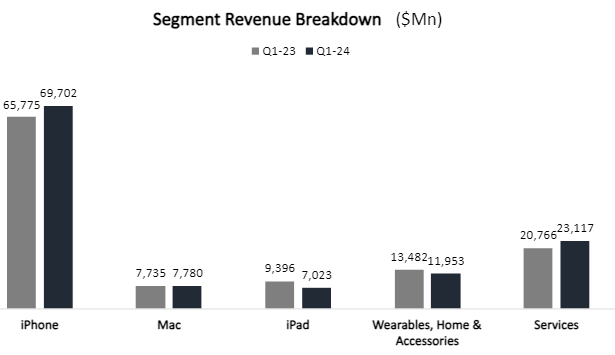

Apple had revenues of $120 billion in the quarter, up 2.1% Y/Y, with product revenues coming in flat at $96 billion, and services growing 11.3% to $23 billion.

Created by the author based on Apple’s financial reports

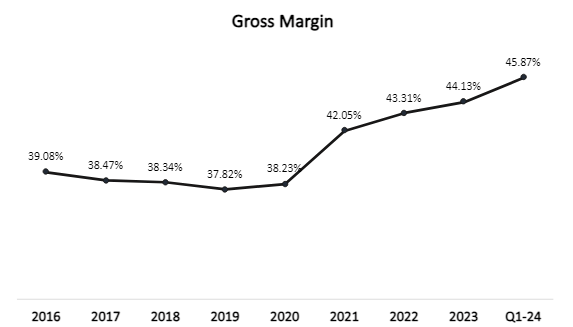

As revenue mix continues to tilt towards services, which reached a Q1 high of 19.3% of sales, margins continue to improve significantly. Gross margin reached an all-time high 45.9% in the quarter, with both services and products achieving record profitability.

Created by the author based on data from Apple’s financial reports.

However, in products, some of the improved profitability is attributed to a favorable mix towards the higher-margin iPhone, which was the only category that grew in Q1. As a percentage of product revenue, iPhone was 72%, a level it hadn’t seen since 2016.

The better gross margins and operational efficiency translated to a record operating profit, net income, and free cash flow margins, which came in at 33.8%, 28.4%, and 28.9% respectively. Operating profit was $40.3 billion, net income was $33.9 billion, and free cash flow reached $34.5 billion, growing 12%, 13%, and 26%.

Apple continues to target cash neutrality, yet it’s cash generating continues to outpace its buybacks, dividends, and investments, although they are reducing share count aggressively, with share count declining more than 3% Y/Y.

Undeniably, Apple is maintaining one of the most profitable operations in the world. That being said, it’s clear worries about Apple’s topline growth overshadow those impressive profitability achievements, and in my view, rightfully so.

Valuation

Here is the problem, Apple’s existing businesses are no longer enough for investors. Even without major success in AI, the company might see better times ahead, but I think that for Apple to become a good investment, it will need to have another major hardware release.

The Vision Pro is nice and all, but even major bulls will have a tough time basing an investment thesis on the VR headset by itself.

In addition, the current services business is a great low-double-digit growth opportunity, but with increased regulatory pressures, it’s uncertain whether or not Apple will be able to sustain its strength (although I believe it will).

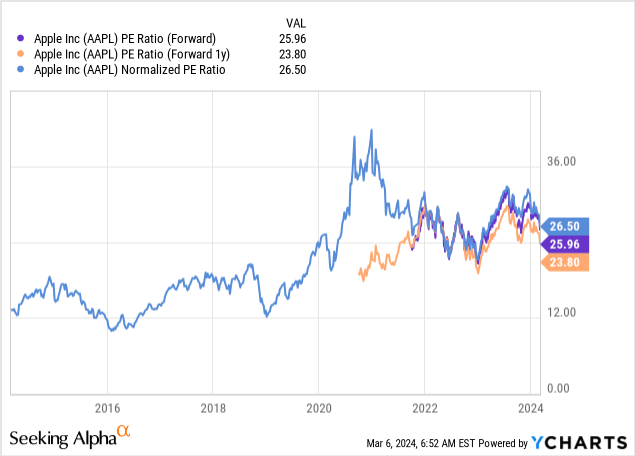

Apple currently trades at a 26x multiple over FY24 expectations and a 24x multiple over FY25. Historically, prior to the pandemic, this is a high valuation for Apple. However, the pre-pandemic Apple didn’t have a $100 billion run-rate services business.

In my view, the current valuation still prices in a bit of optimism about this year’s WWDC being a positive catalyst, but it also prices in a low level of skepticism.

If Apple does deliver with impressive announcements, the stock could easily return to a high-twenties or even a low-thirties multiple. In addition, impressive announcements will most likely mean EPS upgrades, which will drive further upside.

Personally, Apple is less than a mid-sized position in my portfolio, and throughout the year I’ve learned that the worst time to trim or sell Apple is when this much negativity surrounds the company. The other side of that notion is that it’s probably the right time to buy.

I will add to my position if Apple drops below the 24x range, but if its next series of launches and this year’s WWDC don’t show a clear path for acceleration, I will probably exit my position entirely.

Conclusion

Apple is facing major challenges across several fronts, including declining sales in China amid rising competition, increased regulatory scrutiny, and fines that are growing in size.

More importantly, the company has failed to impress with new products or services for several years, and sales are essentially back to 2021 levels.

With that in mind, the recent selloff seems justified, and even at the current valuation, Apple is fairly valued.

However, the company’s ecosystem is as strong as ever, and nobody comes remotely close to Apple when it comes to a dedicated and loyal installed base. As such, I believe the company is in a prime position to deliver innovation on the AI front.

If executed well, Apple’s next growth phase will generate significant upside through accelerated growth and a multiple expansion from current levels.

As such, I rate Apple a Hold, and a borderline Buy if it drops to the 24x P/E range.