Koshiro Kiyota

Thesis

I recommend a ‘Sell’ rating for Apple (NASDAQ:AAPL) primarily due to three factors: signs that their AI efforts may be falling behind those of competitors, stagnant growth, and high valuation multiples compared to Google.

A Brief Narrative

In April of 2010, it was announced that Apple had made an acquisition of a startup. Although terms weren’t made public, it was reported at the time that “the deal was likely small from Apple’s perspective.” And yet, Apple had grand intentions. They saw the potential for this acquisition to transform how users would interact with their devices and continue to widen the technological gap between the iPhone and the rest of its competitors.

What was the name of the company that Apple acquired? Siri Inc.—a personal assistant for the iPhone.

Fast forward to October of 2011, and Apple executive Phil Schiller is on stage for a keynote. Notably absent was Steve Jobs, who was in the final hours of his fight with pancreatic cancer. Although Jobs’ poor health loomed over the company, the iPhone 4S had just been introduced to the world. Attendees of the keynote were excited, eagerly awaiting other announcements. Back then, Apple always had attendees on the edge of their seats.

On stage, Schiller mused about the capabilities of technology. He noted:

For decades, technologists have teased us with this dream that you’re going to be able to talk to technology, and it’ll do things for us. Haven’t we seen this before, over and over? But it never comes true.

This rumination, hinting at pushing the boundaries of technology, piqued the interest of the audience.

Schiller then formally introduced the world to Siri. Interacting with technology through speech was no longer a dream, it was now a reality. Attendees were impressed by Siri’s ability to respond to text messages, look up directions to particular places, retrieve current weather forecasts, and recommend restaurants, among others. No longer was Siri a third-party app; it was now a direct integration into iOS. Apple executives touted it as the “coolest feature of the new iPhone,” and lauded it as an “intelligent assistant that helps you get things done.”

Apple’s Dilemma

So what does the story of Siri have to do with Apple today? In a way, Siri was the world’s first taste of artificial intelligence. After all, Siri’s main selling point was that you could now interact with your iPhone using conversational, natural language. Gone (supposedly) were the days of voice recognition’s broken and limited syntax. Instead, users had the ability to interact with their devices in a free-flowing and instinctive way.

Now, does this sound familiar? Does it sound like many of the technology trends that are buzzing in the today’s headlines? Absolutely. It sounds very much like the AI applications that are occupying today’s news.

It’s remarkable that Apple had such a head start on these types of AI capabilities and use-cases far before the rest of the world but failed to capitalize on their early advantage. We’re talking about a company with thousands of software engineers, billions upon billions of dollars on their balance sheet, some of the brightest minds in Silicon Valley, and a multi-year head start. Still, they were unable to capitalize.

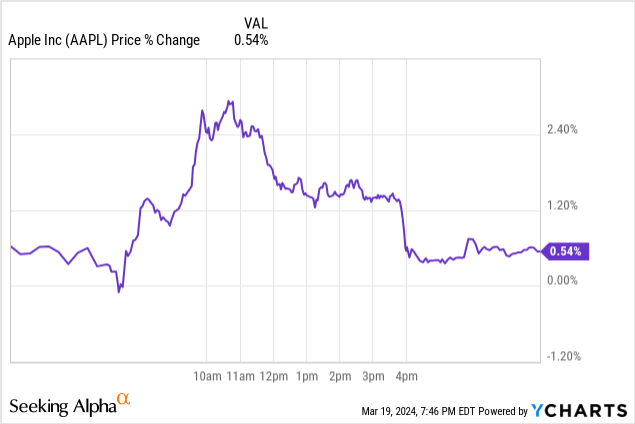

What cemented their inability to capitalize on their early advantage is the recent news that Apple is in talks with Google (NASDAQ:GOOG) to use their Gemini AI model for Apple devices and software. Apple, sensing the need for urgency, is acknowledging that their AI efforts have not kept up with the rapid pace of their competitors. Surprisingly, when this news broke, Apple’s stock jumped as much as 2% before cooling off slightly.

Contrary to what the market seems to believe, it’s my opinion that this is negative news for Apple. Assuming that this partnership becomes official, Apple may be signaling that their AI efforts are not up to par with those of their competitors. This is troublesome given the amount of weight that markets are putting on big tech’s ability to compete in the AI race.

The partnership with Google continues an alarming trend for Apple, particularly with its large-scale projects that have the potential to reach new and sizable markets. For example, it was reported just a few weeks ago that Apple canned “Project Titan,” their team tasked with creating the Apple Car. The project started in 2014 and had a rocky history. The team churned through management and various leaders throughout its life and employed around 5,000 people at its peak. Upon termination, the struggling project still had 1,400 employees working for it and had burnt a total of $10 billion. Apple, despite being as popular and well-capitalized as they are, simply couldn’t pull it off, nor even come close.

Essentially, Apple started and ended up falling short on cars. And now it appears that Apple is trailing in their ability to compete in the AI arms race—instead opting to license technologies from a competitor. They’re starting and falling short on the largest markets possible. This is a concerning trend for a company that, due to their vast size, needs prodigious revenues from any new product line just to barely move the needle.

Valuation

The market is largely valuing big tech on their position in the AI arms race, and assuming that all other business functions are more or less appendages to their AI functions. Microsoft (NASDAQ:MSFT) illustrates this trend well. January 23, 2023, the day of their $10 billion investment in OpenAI, Microsoft’s EV/EBITDA multiple was 18.3x. Today, Microsoft’s multiple is 26.4x. Of course, this multiple expansion has been helped by the strength of the overall market, but it goes without saying that Microsoft has also been rewarded for their lead in the AI arms race.

Assuming this same premise that AI is the future and determines much of the basis for big-tech’s valuation, there is no reason why Apple should be valued more favorably than that of Google. After all, Apple has essentially conceded to Google in the AI arms race.

In line with this thesis, there is starting to be a convergence of Apple’s and Google’s valuation metrics. One year ago, Apple’s EV/EBITDA multiple was 19.1x, while Google’s was 13.8x. Today, the delta between the multiples has narrowed. Apple currently trades at 20.1x EV/EBITDA, compared to Google’s 17.6x.

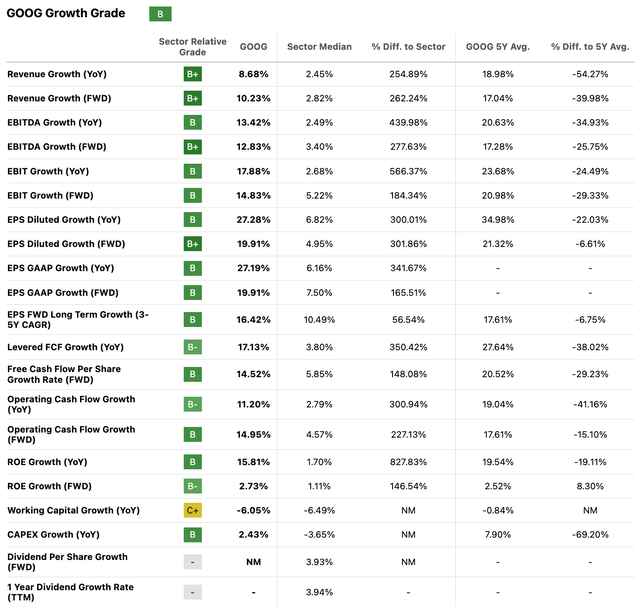

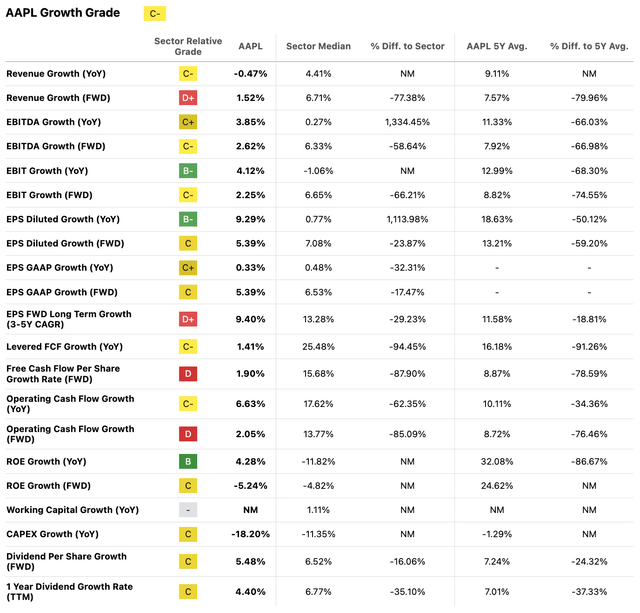

Furthermore, not only does Google have an upper-hand when it comes to AI, but they are also growing at a faster rate. Google’s forward revenue growth and forward EBITDA growth come in at 10.2% and 12.8%, respectively.

This outpaces, by a wide margin, Apple’s forward growth metrics of 1.5% and 2.6%.

Couple each of these factors together, and it seems unreasonable for Apple to command higher valuation multiples than that of Google.

I believe that we will continue to see the multiples for Apple and Google to converge—and eventually diverge with Apple’s multiples dipping below those of Google’s—as time goes on. Apple’s absence from the AI race will only become more and more apparent with time. No longer will they be at the forefront of technology. Instead, Apple will be at the mercy of their competitors for access to their technology.

Risks

With Apple on the outside of AI looking in, the greatest catalyst for their future will be the Apple Vision Pro, which, in their own words, is the “most ambitious product that Apple has ever created.” The Vision Pro stands as Apple’s ticket back to relevancy. Of course, at its current price point of $3,499+, it’s a long way from becoming mainstream. But if their recent launch demonstrated anything, it’s that their most devoted and loyal customers are at least open to the new technology.

In many ways, the Vision Pro has the potential to be as transformative and game-changing as the iPhone. It challenges the status quo of what computing has looked like over the last 15-20 years. However, if the Vision Pro is unable to reach mass-market within the next few years, Apple may, once again, miss their opportunity as it’s only a matter of time before competitors jump on the same train.

Another risk for bearish investors is the possibility that Apple will continue to trade at a premium over its peers due to its positioning as a sought-after, luxury brand. It’s possible that these brand dynamics are responsible for the difference in valuation multiples between Apple and other big tech players. After all, there are few brands in the world that garner as much support and devotion as does Apple. This strong backing could help to buoy Apple’s valuation, even during times of stagnating growth and uncertainty within the company.

Conclusion

What Apple has built up to this point has been phenomenal and nothing short of incredible. For years, they have been a darling of Wall Street and Main Street. Wall Street in the sense that they have provided incredible returns for investors, and Main Street in the sense that they are supported by millions and millions of consumers. However, Apple’s throne is starting to show signs of weakness.

The rumors of their potential partnership with Google for the use of their Gemini AI demonstrates that Apple’s AI efforts may be falling behind those of competitors. Pending any unexpected breakthroughs, it appears that Apple has flown the white flag—signaling that they will no longer be at the forefront of technology, but rather at the mercy of the other big-tech players.

This unfolding storyline comes at a time of stagnating growth for the company and casts a shadow over their future. Add in the fact that Apple currently commands higher valuation multiples than that of Google—the very competitor from whom they will be licensing AI services from—and it’s hard to justify their current price. Hence, I recommend a ‘Sell’ rating.