Wirestock

Introduction

Everybody loves Raymond. I’m sure you all remember that show right? That’s how I feel whenever I hear someone talk about Apple (NASDAQ:AAPL) stock. I remember many of my friends talking about waking up early to go stand in line to get the new iPhone that just came out. I was always an Android guy and wondered why people would go stand in line for hours just to get a new phone that seemed to come out like a month ago. Seems like every month there was a new iPhone and the only thing that seemed to change was the camera. I was happy with my Android but all of my co-workers would make fun of me for not having an iPhone. Being in the military, if you didn’t have one you were considered poor. Not really, but you get what I mean. Some people actually look down on others for the products they do/don’t own. Nowadays, owning Apple products is the standard. And when you don’t people wonder why. It is always the iPhone vs Android debate. Apple is indeed a great stock but I’m sure my readers know I’m a dividend investor, hence the name. My goal is to collect my dividends! And while the stock does pay one, the yield is too low for my liking. So, I won’t be adding it to my portfolio anytime soon.

Things I Like About Apple

I remember being on deployment out in the middle of the ocean, hundreds of miles away from land and all of the younger kids would be crowded around each other with their phones out laughing. I would always ask them what were they laughing at, and tell them to get back to work. They would have just airdropped a movie, video, or photo to each other. Then they would ridicule me about how I couldn’t get it because I had an Android. Being underway for months at a time with no land in sight, I would always see them airdropping each other movies. They would tell me I needed to make the switch from Android to iPhone. I’d ask “What’s the difference?” Their answers were consistently “FaceTime, airdrop, camera quality, and the interface (is more user-friendly).” To me everything seemed pretty much the same. I only needed my phone to talk, text, and take pictures. That’s what it did. But the airdrop and FaceTime were nice. Being out to sea for a long time gets boring at times. There’s only so many things you can do to keep yourself entertained. One thing that kept us entertained were movies. They usually play movies every day out to sea but it was always the same ones over and over again. So after years of going back and forth, I finally made the switch to an iPhone. I’m pretty much an Apple guy now. I’m on a MacBook typing this as we speak. My headphones are made by Apple. I have an Apple music subscription. They are a quality company.

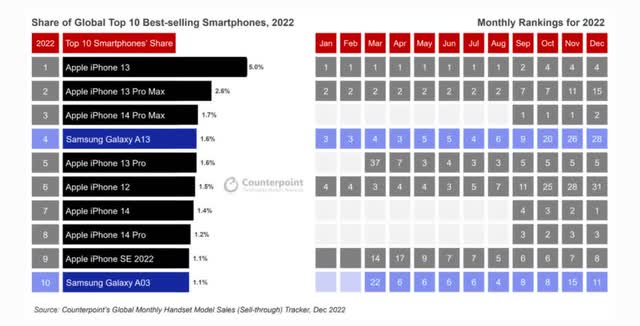

So yes that’s why I like Apple. Their products do seem to be high quality, and that could be why there’s normally lines out the door at their stores whenever a new iPhone drops. They’re a global brand alongside the likes Starbucks (SBUX), Nike (NKE), and Microsoft (MSFT). You really can’t go anywhere in the world without seeing their stores or knowing their brand. As you can see, in 2022, they had 8 out of 10 best-selling smartphones. So now I’ve told you what I like about the company, let’s get into what I don’t like about them.

Too conservative

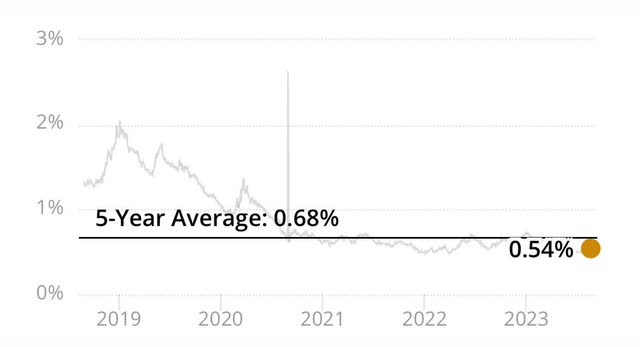

Apple has a current yield less than 1% at 0.54% and a 5-year average of a measly 0.68%. Now I know what people are going to say, Apple is not really a dividend stock, they’re a growth company! I agree. Investing in AAPL years back would have given me a tremendous return. Even investing in them since the beginning of this year would have given me capital appreciation of $72. The stock was trading around $125 in January of this year and reached a 52-wk high of almost $200 at $198.23. That’s an increase of nearly 60%! But as a dividend investor, I typically look for stocks yielding around 4-6%. Some stocks such as Altria (MO) or Capital Southwest (CSWC) yield in the high single digits or even into double (digits). I’m not saying that I will always pass on companies below the 4-6% range, but the dividend growth has to be worthy for me to make an exception.

Modest Dividend Growth

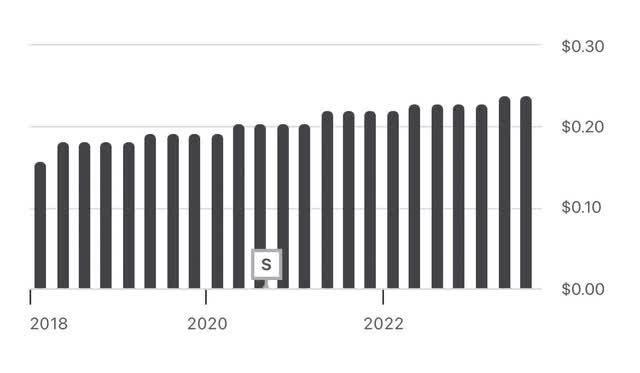

AAPL last raised its dividend by 4.3% to $0.24. Additionally, they announced a plan to buyback $90 billion worth of its shares. Over the last 5 years AAPL raised the dividend just $0.08 to its current dividend. I get it. They’re a growth company and instead of paying a huge dividend, they prefer to invest back into the business which promotes growth. But being one of the most recognizable brands, the cash flow and revenue this company brings in from sales on their products like MacBooks, iPhones, iPads, Apple TV, etc, you’d think they’d paid a higher dividend. They definitely have the cash flow for it. During their Q3 earnings AAPL reported revenue of $81.8 billion and earnings of $1.26 per share. Currently, the company has a very low payout ratio of 19%. They could literally quadruple the dividend and still cover the it safely. But I know they would never do that. That’s not their M.O. They could at least reward shareholders with an end-of-year special dividend or something. Last year AAPL brought in roughly $111.5 billion in free cash flow and paid out $14.8 billion in dividends. This makes it one of the safest companies in the world.

Overvalued

One of the reasons I believe AAPL is overrated and overvalued is because of Warren Buffet. I get it, he’s considered the greatest investor of all-time. Many SA analysts use his name in article titles and follow his stock pickings. I’m a huge fan of him and have invested in some stocks because he liked them or talked about them. But that was early on my investing journey. I definitely keep an eye out for his stock pickings, but that doesn’t mean I agree with all of them. A lot of different things go into selecting stocks such as age, time horizon, investment goals, etc. And because a stock is a good pick for him, that doesn’t mean it’s a good pick for me. But when Warren Buffett buys or sells a stock, it definitely gets the attention of the market/many investors. If he opens a position, it usually moves the price upward, sometimes making the stock overvalued and over-loved. AAPL is currently his biggest holding in the Berkshire Hathaway (BRK.B) portfolio.

Second reason I consider the stock overvalued is because of the current macro environment. Treasury rates are at the highest in over a decade. And because of this the market has seen a lot of volatility over the last month, especially in the real estate sector (VNQ). Additionally, the NASDAQ (NDAQ) is down over 7% in the last 6 months while AAPL is up almost 20% during the same period, making them overvalued in my opinion. When there’s a lot of uncertainty in the economy, like now, many investors will elect to put their money into safe-haven stocks such as AAPL or MSFT pushing them into overvalued territory.

Disney Acquisition?

Many have been saying that Apple could acquire some of Disney’s (DIS) assets since the company announced they were considering potential strategic partnerships. I believe this is a real possibility with the company’s recent push into sports streaming. The company already airs Friday Night Baseball and signed a 10-year deal with Major League Soccer. The company ended the quarter with $166 billion in cash and marketable securities so if the price is right, I think it could be a real possibility. But as previously mentioned, they choose to remain conservative. The company could literally purchase almost any business they so please without putting a dent in its balance sheet. The biggest deal to date for the them is the acquisition they made almost 10 years ago when they acquired Beats By Dre for $3 billion. Apple has a strong balance sheet and one of the highest credit ratings in the business. At the end of Q3 they had a cash balance of $57 billion after repaying $7.5 billion in maturing debt.

Headwinds

Even for a company as big as Apple, they still face risks. Although company management reported record revenue in Services at $21.2 billion, iPhone and MacBook revenue were both down year-over-year, with iPad revenue being the biggest loser down 20%. Products revenue was also down 4% year-over-year, with management citing the current macro environment as the cause. In a recession I expect to see sales in the company continue to decline over the near-term as consumer spending becomes tighter during these times. And with the FED prepared to hike rates further if needed, the company can potentially disappoint during its next quarter earnings. This will definitely put a strain on consumer spending, especially since AAPL products are not considered cheap.

My Valuation

I came to an acceptable buy price using the Graham’s Valuation Model from the “father of value investing” himself Benjamin Graham. Analysts’ are projecting a growth rate of roughly 11% next quarter with EPS expected to come in at $1.39. I have an intrinsic value of roughly $100 for the stock. But given its quality, I don’t think we’ll see Apple come down that low, maybe ever again. Unless they choose to do another stock split. Me personally, I think the stock is a buy in the $150’s and $160’s. Seeking Alpha has a price target of $200 with a low of $149. Buying around its low price target will give investors a nice margin of safety. In the next coming months the stock could drop even lower due to a recession and/or investor tax-loss harvesting.

Conclusion

AAPL is a high-quality stock and one of the most well-known brands in the world. But even as great as they are, the stock has a very low dividend yield and I believe is currently overvalued. If a recession or market correction does occur in the next coming months, I can see the price falling below $170, maybe even into the $150’s. If so, this will give investors a nice upside of 33% to its average price target of $200. The stock also has the potential to keep trending upwards due to the upcoming holidays as people buy their loved ones Apple products. With the current uncertainty in the economy, I think it is more likely the price will fall, giving investors a great entry price into the tech giant. Until then I’m sitting on the sidelines unless this stock sees a major correction in price as it does offer investors great capital appreciation.