Liubomyr Vorona/iStock via Getty Images

Introduction

I’m certain some readers will find the headline of this article provocative, but as anyone knows who watches sports. You can’t be the world champion forever.

In the 1980’s the largest market cap company around was IBM (IBM), who at times had a market cap twice that of the follower, who throughout most of the decade was either AT&T (T) or Exxon (XOM). As we closed that decade, the top ten global market caps were dominated by Japanese companies, with NTT holding a market cap close to $150 billion (a telecom company). Only US companies amongst the top ten were Exxon and General Electric (GE).

The interest for Japanese equities succumbed in the early 1990s, when Exxon, Altria (MO), and Walmart (WMT) fought for the title as largest market cap company. General Electric kept the title throughout most of the decade until Microsoft (MSFT) squeezed past as the internet & PC mania started to accelerate. Eventually, General Electric did close the decade with the largest market cap around $470 billion. Today, General Electric’s market cap stands at $123 billion.

As we started the new millennia, the top ten list contained companies such as General Electric, Microsoft, Exxon, Walmart, Citigroup (C), Pfizer (PFE), Johnson & Johnson (JNJ), and Intel (INTC) and how many of those are still part of that top ten? The answer is one, and that is Microsoft.

As we moved into the 2010s, Apple (NASDAQ:AAPL) made it into the top ten for the first time, when a market cap of “just” $190 billion was sufficient to be included in the list. To make it into the top ten today, it would require a market cap of $500 billion in order to push Visa (V) outside the top ten.

Apple became the largest market cap in the world back in 2012 with $410 billion, when it squeezed past Exxon, who is the 17th largest company today. Except for very brief periods ever since, Apple has been king, but as history teaches us, that rarely lasts, and I believe we are at a point where it will be hard for Apple to keep justifying its title as king regardless of how great a company it is. In fact, it’s a wonderful company but the price sure isn’t wonderful in my eyes.

Core Of The Issue

Apple isn’t growing, which isn’t a problem in itself, but when you start looking at the valuation, then it becomes a problem as there is an imbalance between the two parameters, at least in my opinion.

There probably isn’t any investor out there who doesn’t hold Apple stock directly or indirectly in the form of an ETF. It’s been one of my best performers since I picked it up, but it’s become clear to me that the current valuation is unattainable if Apple doesn’t start showing renewed growth.

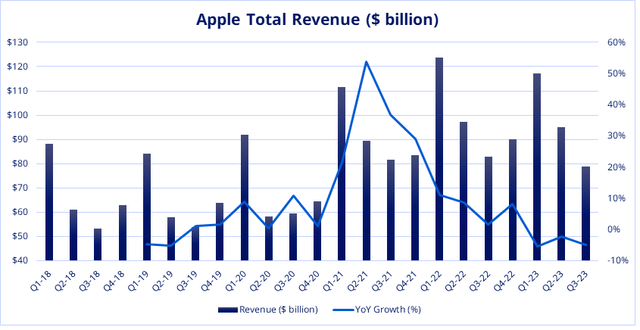

Apple just did something it hasn’t done since 2016, which was posting three consecutive quarters of revenue decline YoY. The story back in 2016 was falling iPhone sales, and as is often the case, history tends to repeat itself.

Back in 2016 revenue developed as follows:

- Q2-2016 revenue came in at $50.5 billion (13% YoY decline).

- Q3-2016 revenue came in at $42.3 billion (11% YoY decline).

- Q4-2016 revenue came in at $46.8 billion (7% YoY decline).

If we look at 2023, this is the picture.

- Q1-2023 revenue (reported in February) came in at $117 billion compared to $124 the year prior.

- Q2-2023 revenue (reported in May) came in at $94.8 billion compared to $97.3 the year prior.

- Q3-2023 revenue (reported in Aug) came in at $81.8 billion compared to $82.9 billion the year prior.

Relatively, those numbers have changed a lot between the two observation periods, but it’s perhaps more interesting when observing how the valuations compare across the two time periods.

Apple Total Revenue Growth (Apple Investor 10-Q)

During 2016, where Apple experienced growth issues, the company traded at a P/E between 9 to 14 while P/S hovered between 2 to 3. If we compare that to today, we get a very different picture.

Apple is currently valued at forward P/E of 29 and forward P/S of 6.8 while revenue is forecasted to grow 6% and 7%, respectively, for the coming two years. Apple is valued as a growth stock, but does mid to high single-digit revenue growth at peak income margins sound like a growth story to you?

It doesn’t to me at least. Apple secures incredible amounts of free cash flow in excess of $100 billion which is absolutely eye-watering and allows the company unseen flexibility in terms of aggressive acquisitions or whatnot, which should play in favour of its valuation in the form of a premium, but it doesn’t bridge the gap between its operational performance and valuation as a strong growth story.

Vectors For Growth

At this year’s Worldwide Developers Conference, Apple announced its newest major product, the VR headset Vision Pro. However, if we disregard this recent launch which won’t create meaningful revenue for some time, Apple hasn’t provided the world with a major product launch since its Apple Watch. The Apple Watch was released back in 2015 and today has in excess of 100 million users, which is why I consider it a major product, also due to the fact that Apple provides standalone revenue numbers for it, similar to the iPhone, MacBook, iPad, and services segment.

Eight years is a long time without having conducted a major launch, and speculations have been many in terms of what Apple’s next venture might be. So far, none of the speculations have turned out to be true, instead, Apple has grown its existing business to the point where it’s a very mature luxury technology brand.

With the OECD economies being stable and showing limited growth, it’s fair to assume that Apple has saturated its market in these countries after having provided iPhones for more than fifteen years as the longest-standing major product, with the Apple Watch being the latest addition. Any given household can only contain so many iPhones and MacBooks. One glimpse at the market shares in for instance Europe, and it does indeed appear like they have peaked e.g. 30% for the iPhone, while that market share is larger in the US at just above 50%. In both instances, these levels have been stable for some time.

However, the world is more than just the OECD economies.

Asia (excl. China) The Next Growth Opportunity For Apple?

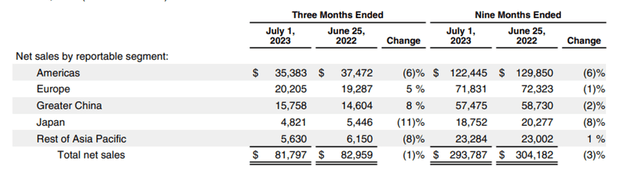

Year to date (Apple’s Q1-Q3) Apple has secured $231 billion in revenue, which is split as follows

- $122 billion for the Americas

- $71.8 billion for Europe

- $57.5 billion for Greater China

- $18.8 billion for Japan

- $23.2 billion for rest of Asia Pacific

Apple Q3-2023 Regional Sales Distribution (Q3-2023 10-Q)

All major currencies reported here developed negatively compared to the USD YTD, which shows itself as a negative influence in revenue numbers, but despite of this, only one region has shown some form of growth YTD, which is the Asia Pacific region.

A rule of thumb says that once GDP per capita crosses $3000, the citizens of that nation start being able to pick up discretionary products consumed by middle-class citizens in OECD economies, such as Apple products & services. This is of course an average, which doesn’t take massive societal inequalities into consideration amongst most developing nations, so it should be used as a rule of thumb, but it does give some perspective in terms of what’s the current situation and outlook.

The largest five nations in Asia rank as follows according to the size of its population.

- India with a population of 1.4 billion (GDP per capita of $2.600)

- China with a population of 1.4 billion (GDP per capita of $13.700)

- Indonesia with a population of 272 million (GDP per capita of $5000)

- Pakistan with a population of 240 million (GDP per capita of $1.700)

- Bangladesh with a population of 173 million (GDP per capita of $2.500)

These are some of the largest nations in the world, in fact, Asia is home to every second person globally.

Evidently, China is well ahead of the other nations, but these countries are all exhibiting a growing middle class with room to grow for Apple. India is an obvious opportunity as it’s the largest nation on earth. There is still room for opportunity as India has a similar Gini coefficient to China but is being significantly behind China on the HDI coefficient (Human development index). These statistics cover equality, education, life expectancy, general health, and so forth. Suggesting to me, that while the situation is improving, most citizens have more important things to plan in their life, than when they might hope to pick up their first iPhone. However, that will naturally change as general living standards in these nations improve over time.

These emerging Asian markets won’t mature tomorrow, but it is an avenue for Apple that’s largely unexplored as also exemplified by the fact the iPhone only holds a 4-5% market share in India today. There’s some light to that story though, as Apple used to have a 2% market share back in 2019, so it’s already growing strongly, and I don’t see why Apple shouldn’t be able to grow substantially over the coming years. There is a different competitive landscape to consider, as Xiaomi holds the number one spot with a market share of just above 20%. Point being that Chinese brands are a non-factor in most OECD countries but would be a viable competitor in a market such as India, which limits the potential for outside brands, even one as strong as Apple.

There is no denying the strong brand of Apple, and its marketing muscle will ensure it establishes a foothold of significant proportion, even if the competitive landscape and consumer preferences are slightly different. This is an opportunity for Apple, but also one that will have to develop over time, in an uncertain timeframe.

The Continued Expansion Of The Services Ecosystem

Apple reports its revenue in two segments, products which consist of the well-known family of high-value items we all know, and then the services segment which is a bit under the radar for most. It’s the App Store, Apple Pay, Apple Card, and subscription services such as Apple TV, Apple news, Apple Music, and Cloud.

As of this quarter, the company now has more than one billion paid subscriptions across all apps and services. Yes, you heard that right, one billion. Even more astonishing is the fact that paid subscriptions grew 150 million YoY.

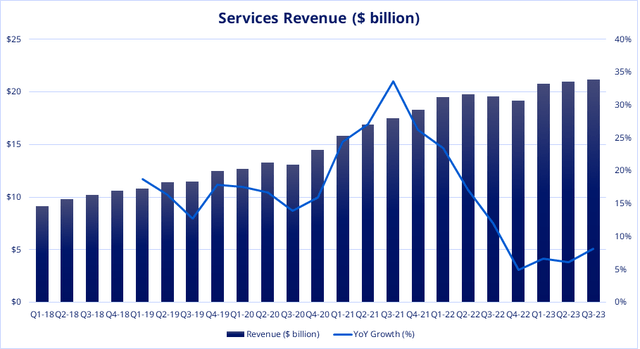

The products family isn’t the catalyst they used to be, particularly the iPhone, so the services ecosystem has been playing a growing role.

Apple Services Revenue Growth (Apple Investor 10-Qs)

If there is one thing we have learned over the past decade, then it is that ecosystems can be monetized to a large extent. Meta (META) has successfully done so with its billions of users to grow a high-margin business. Similarly, Apple has been expanding its services offering, most recently via a subscription-based news app and its more widely discussed credit card and deposit model. The credit card setup is naturally designed around a cash-back model, incentivizing consumers to purchase Apple services via this setup. This effectively builds a fence around the consumer. Smart.

I’ve included the quarterly revenue from Apple’s services segment as well as YoY growth between quarters. Almost consistently, Apple has been delivering sequential growth, which is quite stunning considering it’s now grown to an $80 billion annual revenue business when considered in a forward-rolling twelve-month scope. Impressive.

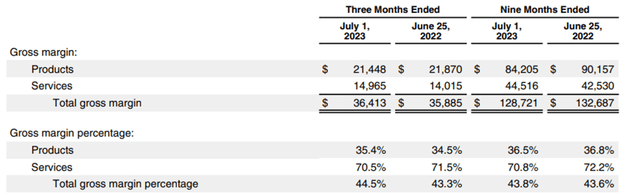

Apple Segment Margins Q3-2023 (Q3-2023 10-Q)

I mentioned margins before and looking at the most recent 10-Q from Q3-2023, it’s evident how Apple is spinning gold on its services segment. While it can be difficult to identify the next new service that would launch successfully, it’s more suitable for the business to build bolt-on ideas into the services ecosystem compared to complex physical products. Perhaps also at smaller risks, as they can be brought to life following a “trial and error” methodology, as compared to a flagship product.

I wouldn’t underestimate the possibility for Apple to successfully continue expanding this part of its business, although there is a natural barrier as to how much further it can go, given the fact that they now carry in excess of one billion paid subscriptions and also that consumers naturally can’t allocate an unlimited amount of their monthly budget to Apple services. This is also visible in the illustration I included earlier, exhibiting how growth has slowed, albeit still being impressive for such a large division.

Apple’s Financial Firepower & R&D Budget Secures Optionality & Flexibility

Apple is a business with an ROIC (‘return on invested capital’) in excess of 25% consistently over the past decade. The 10Y median is 27% and the 5Y median is 38% as ROIC expanded dramatically since the Covid-19 driven surge in demand for Apple products and services. In other words, profits exploded while the asset base remained stable.

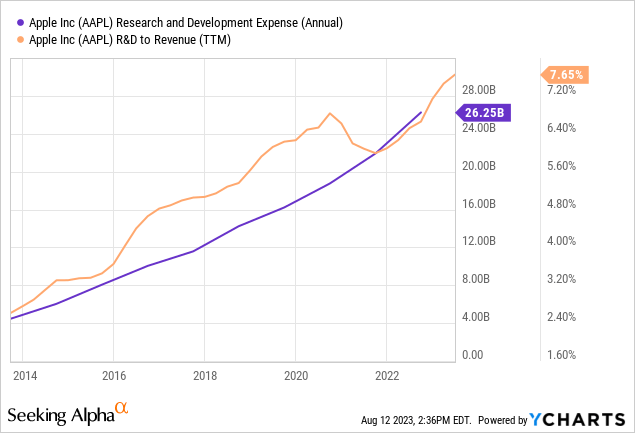

Besides this, Apple holds one of the largest R&D budgets you can find only eclipsed by other tech peers Alphabet (GOOGL), Microsoft, and Meta. Having the luxury of being able to allocate such a massive amount of capital to R&D naturally ensures that Apple has the capacity to strengthen its existing platforms and also secures that new ideas come into life with the strongest starting point possible.

Lastly, we have Apple’s free cash flow generation which is currently just above $100 billion annualized. That is absolutely flabbergasting.

What’s the point of all this? The point is, that if you are running a high-margin business with strong returns on invested capital, carrying a massive R&D budget while having the strongest free cash flow generation out there – you have a margin for error. And quite a bit of margin actually.

It’s hard to argue that Apple isn’t run by a strong management team, so combining all of this and it’s perhaps the one reason why I would say that Apple stock never qualifies as a sell. There is simply too much optionality with such strong a business, even despite its valuation.

Investment Strategy & Wrapping It Up

Alright, so I just said that Apple never qualifies as a sell, but that doesn’t mean it qualifies as a buy either.

Apple’s valuation is, in my opinion, so high, that it won’t make much of a difference if the company manages to increase free cash flow from $100 billion to $115 billion over the coming two or three years. It won’t move the needle when you are a three trillion-dollar market cap company at a forward P/E close to 30 and forward P/S close to 7.

It requires a significant reinvigoration of growth before the company can justify its current valuation and being forecasted at mid to high single-digit growth on both top and bottom lines, I don’t find the stock appetizing at this point. Combining the forward 0.5% yield with a growth of mid to high single-digit, and you do get close to the long-term average market return of 10%, but that’s not really impressive when you are the world’s largest company measured by market cap, trading at a bloated valuation, is it?

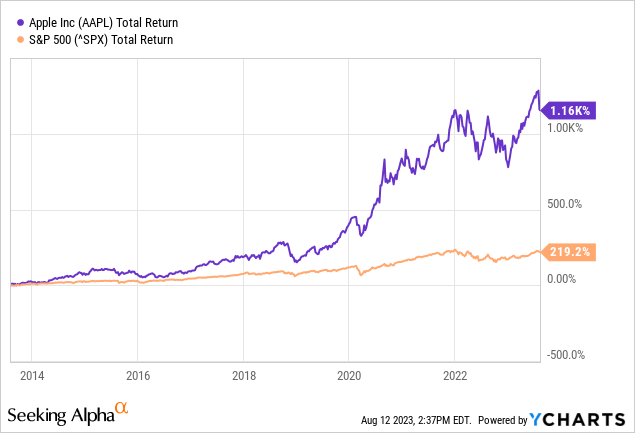

Apple has been a market-beating stock by a large margin over the past decade, but I don’t see the potential for that to continue right now. I do see potential in Apple to strengthen its foothold both geographically and in terms of its services ecosystem. This combined with the massive returns on its business makes Apple a difficult prospect to bet against, but at this point, I’d hold and not buy – And I’d never have the nerve to sell this stock, simply because of its brand, product strength and incredible ability to generate cash which can be piled into either reducing the existing float of shares or new ventures, possibly even a meaningful acquisition at some point.

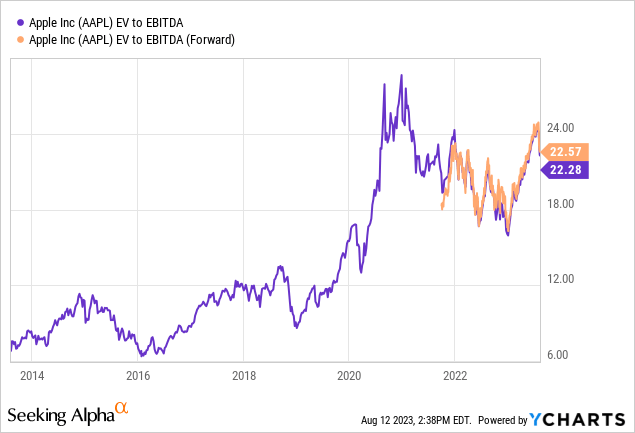

Perhaps the best illustration that gravity isn’t how it used to be is observing the EV to EBITDA multiple, which evidently has moved to whole other levels since Covid-19 and the extreme availability of liquidity became the new normal.

Personally, I’ve trimmed my stake in Apple twice, the first time was back in 2020 and now again here in 2023, I do plan on holding my remaining pile as it’s back to being a 2% weight in my portfolio in combination with the fact that it’s a top holding in a growth-related ETF I’m holding.

If I didn’t have Apple stock already, I wouldn’t buy today, but since I do, I’d hold onto them as it wouldn’t be the first time, I’ve been surprised by how far the market cap can swell.

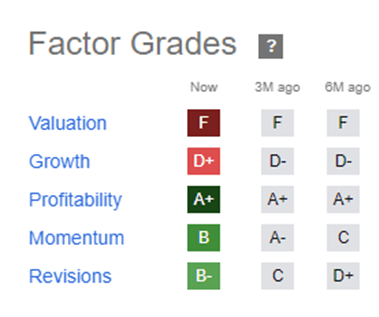

Apple Factor Grades (Seeking Alpha)

Apple carries a consensus twelve-month Wall Street price target of $199 per share, which I think is bonkers. Apple is currently a story of strong momentum, but I’m not investing purely based on what’s in flavour. I strive to invest when there is a balance between what you are getting and what you are paying for, and that balance isn’t in place right now.