Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) has reported mixed earnings in the recent quarter. While Services segment has shown a good growth rate, all other segments have performed below expectations. However, Apple has managed to show EPS growth from the year-ago quarter. Diluted EPS in the recent quarter was $1.46, up from $1.29 in the year-ago quarter which is equal to a 13% jump. On a trailing twelve-month basis the diluted EPS growth has been modest, rising from $6.11 in fiscal 2022 to $6.13 in the recent twelve-month period. One of the reasons behind slower EPS growth is the rapid increase in R&D expenses. It was mentioned in a previous article that some low margin services like Apple TV+ are already causing a headwind for Apple’s profitability.

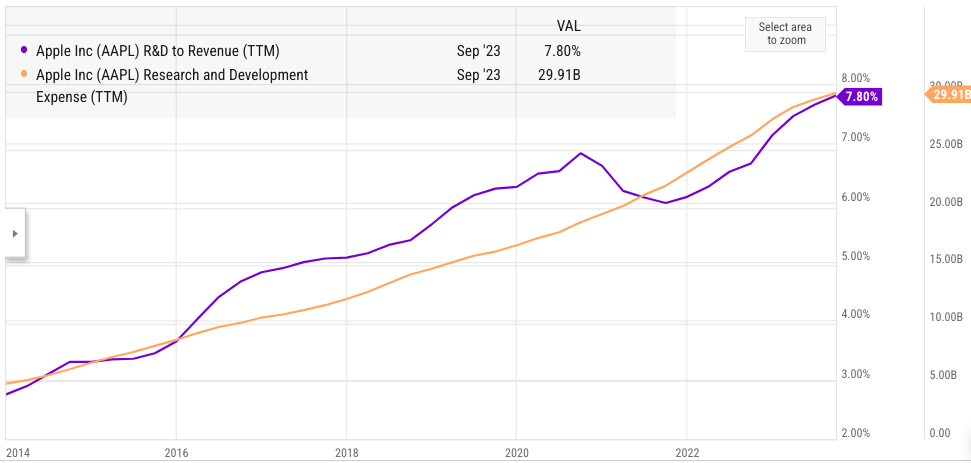

Apple’s R&D expense has increased by 8% YoY in the recent quarter while the revenue declined by close to 1%. This has increased R&D to revenue ratio. We have seen this trend for the past ten years, as Apple’s R&D expense increased from $5 billion in 2014 to $30 billion in the recent fiscal which is equal to 20% CAGR. The R&D to revenue expense of Apple in the trailing twelve months was 7.8% compared to 2.9% ten years back. This is a headwind of 5 percentage points for operating margin on a standalone basis.

R&D expense is generally considered a must for big tech companies and many other competitors of Apple are spending a much higher percentage on R&D. Ideally, higher R&D expense should help in building better product innovation. However, Apple has not delivered any major product pipeline in the last few years. Most of the operating income growth has been due to improvement in Service revenue, especially the licensing revenue from Google (GOOG) and App Store. If the current trajectory continues, we should see R&D to revenue expense climb to 12-13% by end of this decade. This would be another 5 percentage point headwind for the operating margin and will significantly impact EPS growth rate. Apple’s revenue growth is likely to be modest at best in the near term and any decline in margins could have lower EPS and cause a more bearish sentiment towards the stock.

R&D expense is off the charts

Apple’s R&D expense has been growing rapidly for the past few years. This metric is often overlooked while Wall Street focuses on other aspects of the business. From less than 3% in 2014, R&D to revenue expense has increased to 7.8% in the trailing twelve months. There was a minor dip in this metric during the pandemic due to higher revenue growth. However, in most of the years, Apple’s R&D expense has been significantly higher than the revenue growth.

Ycharts

Figure: R&D to revenue expense in the last few years

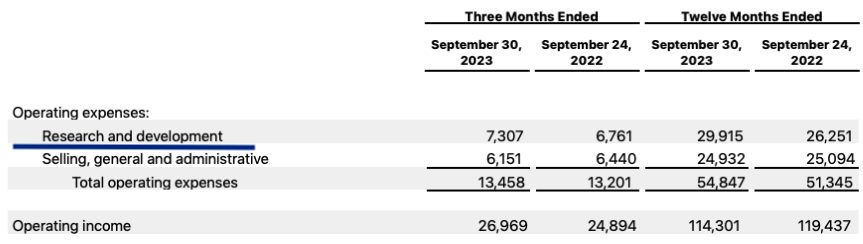

In the recent quarter, R&D expense came at $7.3 billion which was 8% increase from $6.7 billion R&D expense in the year-ago quarter. For the trailing twelve months, R&D expense was $29.9 billion which was 14% jump from $26.2 billion in the previous fiscal. During the same time period, net sales declined by 3%. Hence, we can see that the impact of R&D growth has been quite high. The operating income of Apple declined by $5 billion in the trailing twelve months. A whopping $3.7 billion of this decline was due to higher R&D expenses.

Company Filings

Figure: Impact of R&D expense on Apple’s bottom line

Where is the product pipeline?

Apple’s management has been very successful in building a strong licensing revenue and App Store business. These income streams have very high margins and have contributed significantly to the bottom line. However, there are major regulatory challenges faced by both these revenue streams. Even without the regulatory headwinds, it would be difficult for Apple to sustain long-term revenue and profit growth on the back of only these two revenue streams.

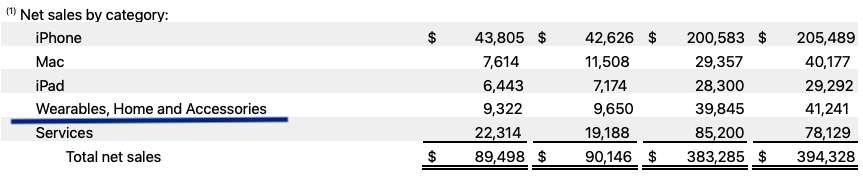

Apple has invested heavily in its R&D department. The increase in R&D expense would be acceptable if Apple had a strong product pipeline. However, most of the revenue base is still contributed by its traditional products and services. Apple’s HomePod and other home devices have failed to corner market share away from Amazon (AMZN) and Google. This is reflected in the decline in Wearables, Home and Accessories.

Company Filings

Figure: Decline in revenue within Wearables segment

Some analysts have pointed to the potential of Apple in VR segment. However, the bill of materials for Apple’s VR headset is more than $1,500. Meta (META) has a strong first-mover advantage in this segment and it has the resources to protect its market share.

Apple’s track record is not good in taking away market share from Big Tech companies in US. We have seen this in the smart speaker business. It is likely that Wall Street will start questioning the product pipeline of Apple if the company reports another few quarters of revenue decline in the products category.

Headwind for EPS growth

Apple has been able to deliver strong EPS growth despite modest revenue growth. As mentioned above, the growth in lucrative Services revenue has helped the company a lot. However, rapid increase in R&D expenses will put a big dent in future EPS growth. As an example, if Apple’s R&D to revenue expense was similar to ten years back, the company would have reported operating margin of over 35% which would be a staggering number.

Any decline in future margins would become more acute if the revenue growth is in the negative or low single digits. If the current trend continues, the R&D to revenue expense should increase to 12-13% by the end of this decade. This would put another 5 percentage point headwind for the operating margin and hurt EPS growth of the company.

Impact on Apple stock

Any delay or setback in future product launches will lead to more questions on Apple’s product innovation capabilities. All other Big Tech companies including Amazon, Google, Meta, Microsoft (MSFT), and Tesla (TSLA) are investing heavily in new products. Apple is already facing a slowdown in its Product category. The Services segment is completely dependent on the strong customer base of Apple products. If there is significant decline in market share of key products, we could see a lower valuation multiple for Apple despite good Services performance.

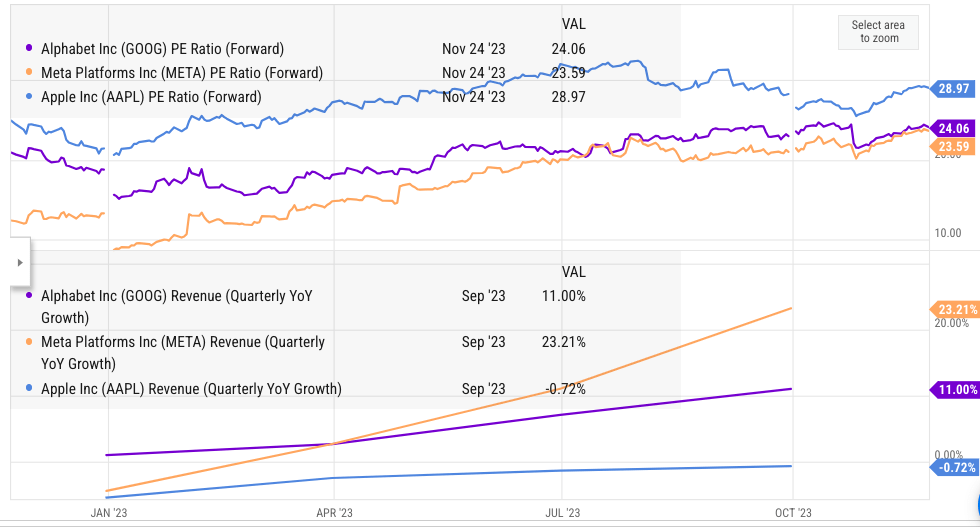

Ycharts

Figure: Comparison of Apple, Meta and Alphabet’s revenue growth and forward PE

Apple’s forward PE multiple is significantly higher than other tech majors like Alphabet and Meta. On the other hand, Apple’s YoY revenue growth is the lowest among all the big tech companies. The forward revenue growth projections of Apple are also not optimistic. Most of the customer demand for Apple goods got pushed ahead during the pandemic and we could see slower revenue growth from Apple for a few more quarters.

Apple has been increasing its R&D headcount while other tech majors have been optimising their employee cost. This puts additional pressure on the management to deliver robust product lineup.

Investor Takeaway

Apple has increased its R&D expense at 20% CAGR over the last ten years, increasing from $5 billion in 2014 to $30 billion in the recent fiscal year. This has increased the R&D to revenue expense from 2.9% to 7.8%. Increase in R&D expense has been a 5 percentage point headwind for the operating margin on a standalone basis. In the recent fiscal, most of the decline in operating income could be attributed to increase in R&D expenses.

At the same time, Apple’s product lineup is not strong and the company is reporting a decline in product sales. It faces massive challenges in several key product segments from big tech companies like Amazon, Google, and Meta. Despite slower revenue growth, Apple’s stock is trading at a premium compared to Alphabet and Meta. Any major setback in future product launches could cause a big correction in the stock as the valuation level is already quite high compared with the historical average.