aislan13/iStock via Getty Images

Thesis

I have been fascinated by technology and the impact it has on our daily lives since I was very young. I watched Apple Inc. (NASDAQ:AAPL) make waves during the rise of desktop PC’s, become a leader in portable music, and then go on to revolutionize the smartphone market. In each of these cases, Apple was able to find success because their products offered a new, more effective way to interface with technology.

As we make continued advancements with our technology, the need to seamlessly incorporate it into the human experience is more urgent than ever. Desktop PCs took almost two decades to become cheap enough that they became common. Most of the industrialized world became dependent on their smartphones within a decade of introduction. I believe the next revolution in cybernetic integration is augmented reality.

Apple’s culture of innovation grants them a long-term competitive advantage that few others share. While not every new product is as revolutionary as the Apple I in 1976, or the iPhone in 2007, the company has proven it is willing to take risks in emerging markets. Because they are constantly developing new products and services, and already enjoy strong brand loyalty, I consider Apple a spawner with wide moats. After looking over their financials and valuation, I presently rate Apple as a Buy.

Company Background

Apple Inc. is a multinational technology company specializing in consumer electronics, software services, and online services. They are headquartered in Cupertino, California. They were started as the Apple Computer Company in 1976 by Steve Wozniak, Steve Jobs, and Ronald Wayne. Presently, Apple is listed as one of the most valuable brands globally. The company has a large following and enjoys very high brand loyalty. They have adopted a recycling program, and regularly sponsor internships.

They regularly release new products and have a reputation for innovation. On June 5th, they introduced their own version of augmented reality glasses. Apple is referring to it as the first spatial computer. They are currently promoting it as an educational tool, but I expect that augmented reality will eventually have an major impact on how we live our everyday lives.

Long-Term Trends

The global consumer electronics market is projected to have a CAGR of 5.3% through 2027. The global smartphone market is expected to experience a CAGR of 7.3% until 2029. The desktop PC market is projected to have a CAGR of 0.98% until 2028. The tablets market is expected to have a CAGR of 1.74% through 2028. The software-as-services market is projected to experience a CAGR of 19.7% until 2029. The market for wearable technology is projected to have a CAGR of 14.60% through 2032. The augmented reality market is projected to experience a CAGR of 50.7% until 2030.

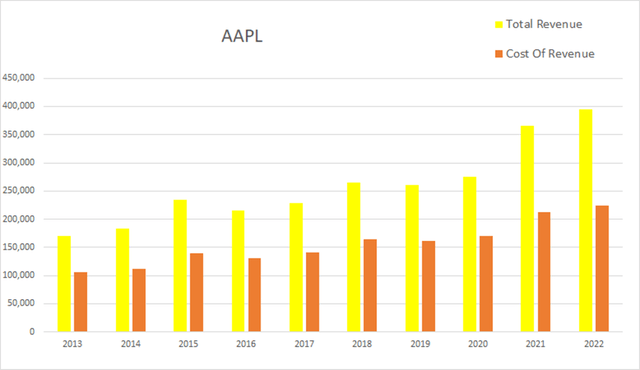

Annual Financials

Apple has more than doubled its revenues over the last decade. In 2013 they had an annual revenue of $170.9B; by 2022 that had increased to $394.3B. This represents a total rise of 130.7% at an average annual rate of 14.52%.

AAPL Annual Revenue (By Author)

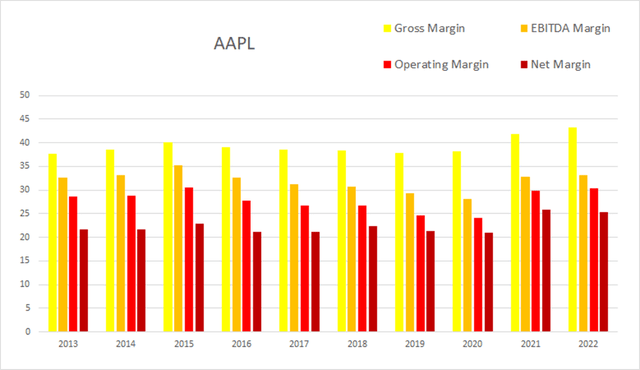

Overall, the company enjoys consistently excellent margins. They did experience a minor margin contraction from 2015 through 2020, but that was followed by a significant expansion in 2021 and 2022. As of the most recent annual report, gross margins were 43.3%, EBITDA margins were 33.1%, operating margins were 30.3%, and net margins were at 25.3%.

AAPL Annual Margins (By Author)

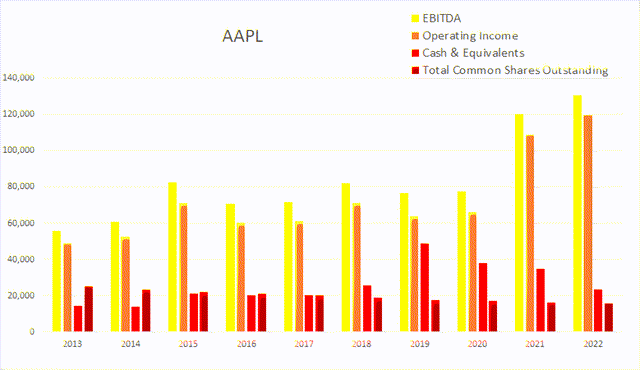

Their overall share count has been dropping while income has been rising. Total common shares outstanding was at 25.178B in 2013; by the end of 2022 that [Fell/Rose] to 15.943B. This represents a 36.68% decline in share count, which comes out to an average annual rate of -4.08%. Over that same time period operating income rose from $48.999B to $119.437B, a 143.75% total increase, or an average annual rate of 15.97%.

AAPL Annual Share Count vs. Cash vs. Income (By Author)

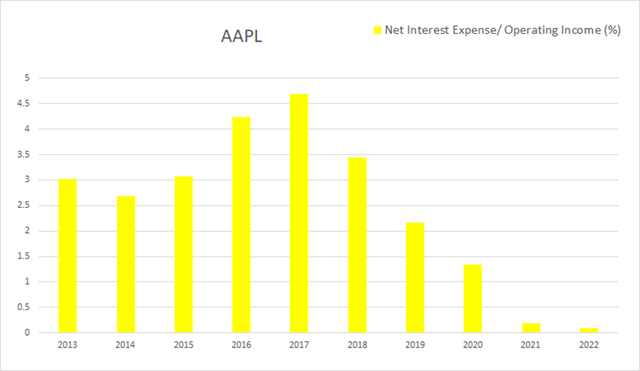

Their debt situation is particularly attractive. As of the 2022 annual report, 0.088% of their operating income was consumed by their net interest expense.

AAPL Annual Net Interest Expense vs. Operating Income (By Author)

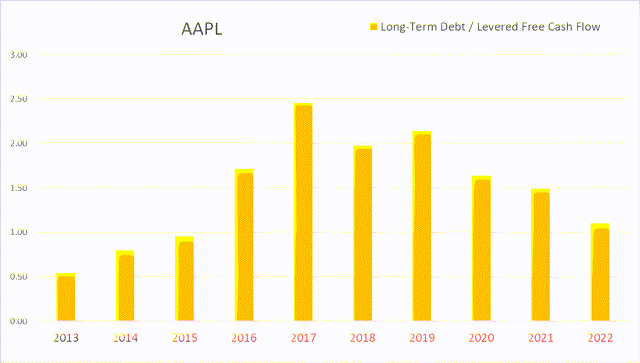

If they were to desire to, Apple could choose to pay off their long-term debt in about a year. As of the most recent annual report, long-term debt to levered free cash flow was 1.10x.

AAPL Annual Debt vs Cash Flow (By Author)

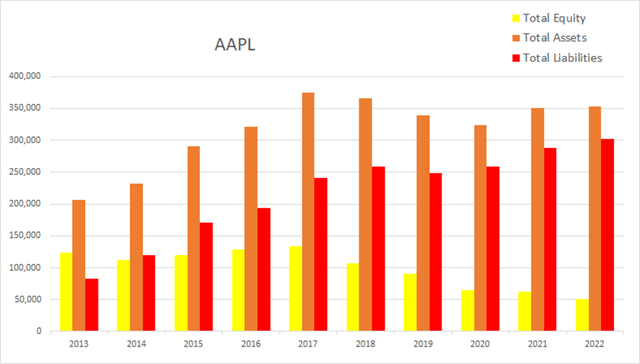

Their total equity has been falling since 2017. This is not unusual when corporations buyback large amounts of shares.

AAPL Annual Total Equity (By Author)

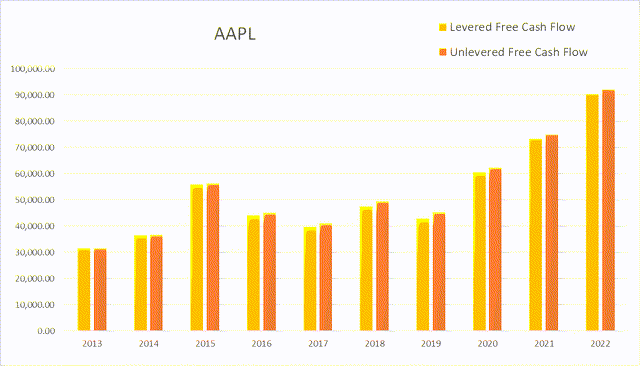

Their cash flow situation has been improving over the last several years. As of the most recent annual report, levered free cash flow was $90,215M, and unlevered was $92,047M.

AAPL Annual Cash Flow (By Author)

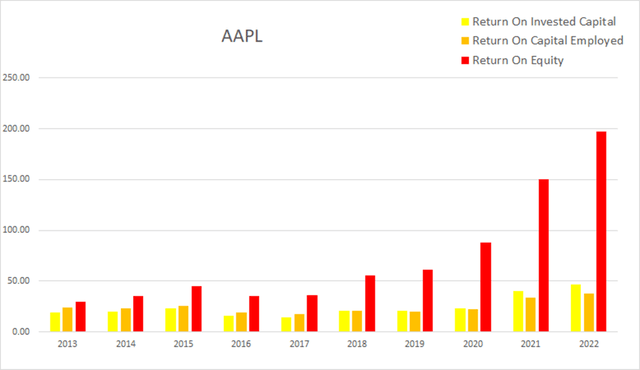

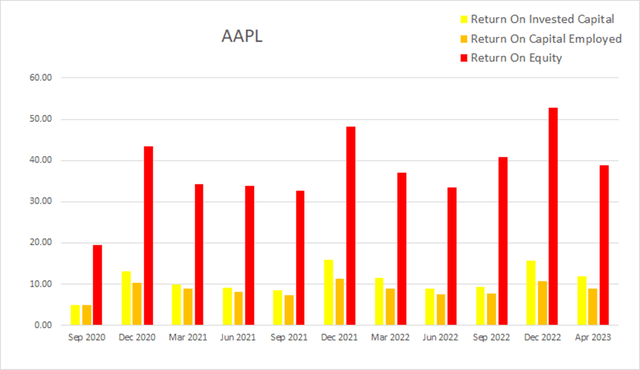

Their diminishing equity is skewing their values for return on equity. For most of the last decade, Apple was able to maintain return on invested capital values in the mid-teens and lower twenties, but it has experienced a significant expansion in the last two years. As of the most recent annual report, ROIC was 46.7%, ROCE was 37.4%, and ROE was at 197.0%.

AAPL Annual Returns (By Author)

Quarterly Financials

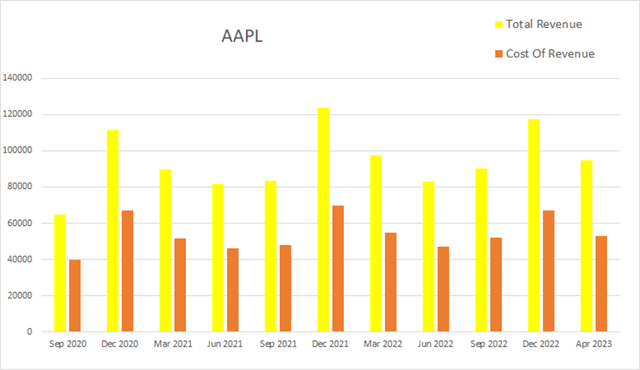

Their quarterly financials show clear seasonality. Apple typically experiences lower revenue every Q2 and elevated revenue every Q4. Eight quarters ago, Apple had a quarterly revenue of $89.6B. Four quarters ago that had grown to $97.3B; by this most recent quarter it fell to $94.8B. This represents a total two-year increase of 16.46% and an average quarterly rate of 2.06%.

AAPL Quarterly Revenue (By Author)

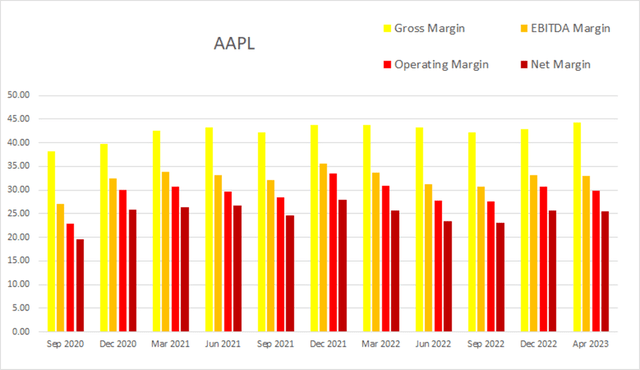

The seasonality that heavily affects their revenue does not seem to significantly affect their margins. As of the most recent quarter gross margins were 44.26%, EBITDA margins were 32.92%, operating margins were 29.86%, and net margins were at 25.48%.

AAPL Quarterly Margins (By Author)

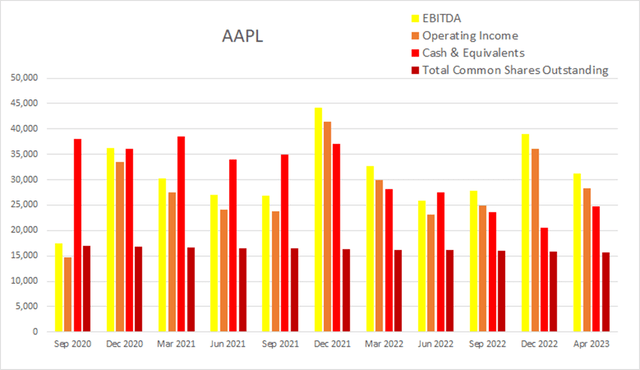

As of the most recent quarter they had cash and equivalents of $24,687M, EBITDA of $31,216M, and quarterly operating income was $28,318M.

AAPL Quarterly Share Count vs. Cash vs. Income (By Author)

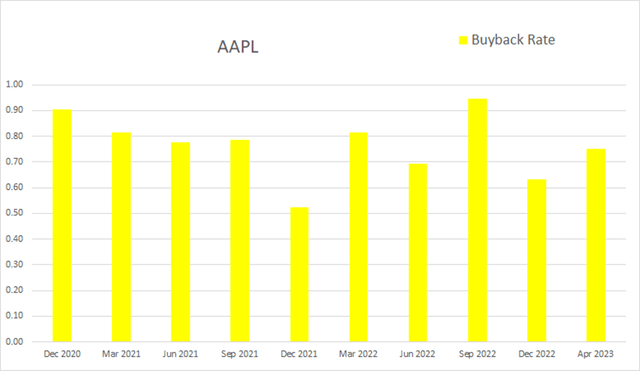

They have been maintaining a fairly stable buyback rate. The sum of their last four quarters of buybacks comes to 3.02%.

AAPL Quarterly Buyback Rate (By Author)

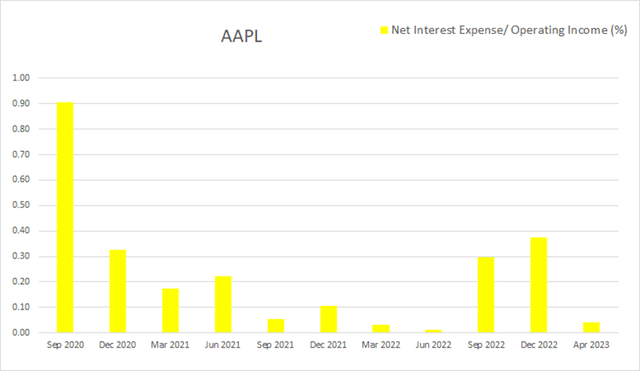

Their regular debt obligations continue to be dwarfed by their income. This most recent quarter, Apple paid $12M in net interest expense, yet had $28.3B in operating income, and $24.2B in net income.

AAPL Quarterly Net Interest Expense vs. Operating Income (By Author)

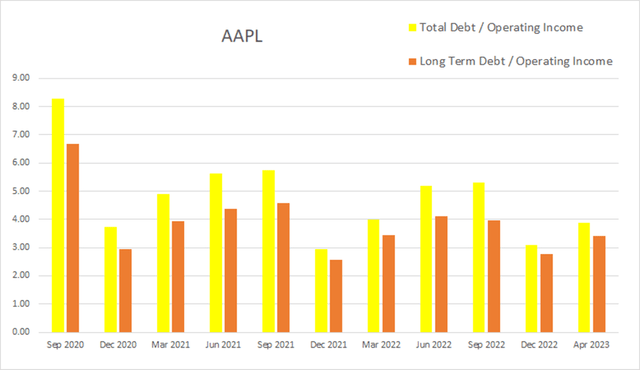

Their overall debt level remains fairly stable. As of the most recent quarter, total debt was at $109,615M, and long-term debt was at $97,041M.

AAPL Quarterly Debt (By Author)

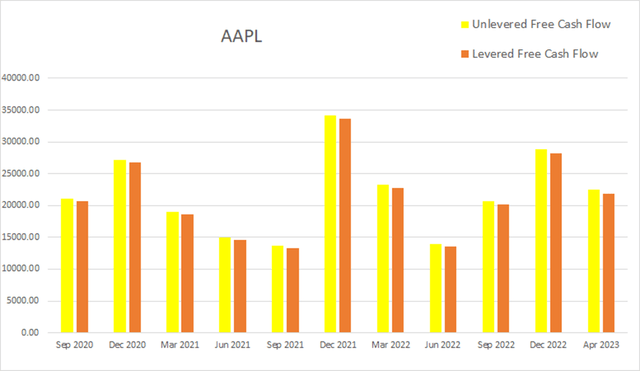

While it didn’t show up very well in their margins, the seasonality that affects their revenue also shows up in their quarterly values for cash flow. As of this most recent earnings report, unlevered free cash flow was at $22.4B, while levered free cash flow was at $21.9B.

AAPL Quarterly Cash Flow (By Author)

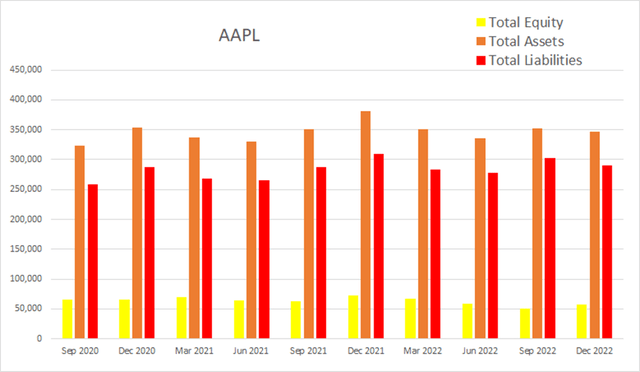

The pace of their equity decline has diminished. Their total equity has remained fairly stable for the last ten quarters.

AAPL Quarterly Total Equity (By Author)

Seasonality also affects their returns. With the exception of their elevated Q4 values, return on invested capital typically lands in a range between 8.5% and 10%. As of the most recent earnings report, ROIC was 11.96%, ROCE was 8.86%, and ROE was at 38.87%.

AAPL Quarterly Returns (By Author)

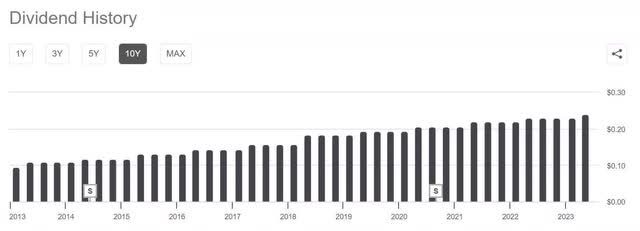

Apple first began offering a dividend in 2012 and has been steadily increasing it since then. With the company consistently posting attractive returns, and the yield currently around only a half a percent, this is probably one of the safest dividends available.

AAPL Dividend History (Seeking Alpha)

Valuation

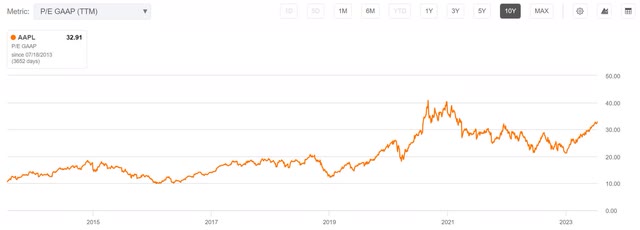

As of July 18th, 2023, Apple had a market capitalization of $3.00T and traded for $193.61 per share. Using their forward P/E of 31.87x, their EPS Long-Term CAGR of 11.63%, and their forward Yield of 0.50%, I calculated a PEGY of 2.63x and an Inverted PEGY of 0.38x. As this PEGY value is above 1, this implies that AAPL is presently overvalued.

However, high quality companies typically trade at elevated valuations. When a company has a high-quality business model, and the general public already knows it, we often have to ask ourselves a question. By how much are we willing to overpay for quality? AAPL used to trade in the 10x to 20x P/E range, but in 2019 their valuation began shifting up into a new range. Since 2019, it typically trades in the 20x to 40x range and is currently trading at a P/E a little under 32x. This implies that AAPL is only slightly overvalued.

AAPL P/E History (Seeking Alpha)

Risks

Apple’s first augmented reality device, Vision Pro, is expected to be available for $3,499, and will launch in early 2024. I believe this price is attractive enough that it will find a home in classrooms and as a training tool. However, this is expensive enough that most of the general public will not be interested in them. Apple runs the risk of overestimating demand at this price point. Their initial product launch might underperform.

Apple has received criticism for exploiting customers, labor practices, environmental practices, anti-competitive behavior, and unethical materials sourcing. The company has already made steps to mitigate some of these problems, but if they are insufficient, it is possible that enough public outrage builds that a major boycott occurs.

Apple exists in a competitive industry which requires it to be highly adaptable. If they ever lose their culture of innovation, they risk losing their competitive edge and might slip away into irrelevancy. Fortunately, the desire to constantly innovate, even knowing some projects will fail, seems ingrained into the company. I believe this is a relatively low risk.

Catalysts

As successive generations of their spatial computing become available, I expect capability to increase while price drops. As the technology gains traction, Apple will become incentivized to keep regular users interested by offering ever increasing number of features and computing power. As is common with most new electronic products, I also expect them to make efforts to bring the price down over time to increase public appeal. The financial risk of failure for Apple is relatively low, while the future market this opens up for them is potentially huge.

Apple consistently posts high returns. Although each individual earnings report is likely to move the share price, the real gains are in the net result of posting consistently high returns over long time frames. Apple has been a compounder for many years; it appears to me that this will continue.

First-Hand Experiences

I believe the first Apple product I ever used was an Apple IIGS in the late 1980’s. Through the 1990’s, their PC’s ran at cooler temperatures than their IBM compatible competition; this helped earn them a reputation for reliability. I was turned off by Apple’s insistence that I pay for music I already owned, and so viewed iTunes as exploitative. This means I never owned an iPod, but I knew many people that did, and it was clear they were a good line of products. When I eventually decided to switch from a flip phone to a smart phone, iPhones were already the highest rated products on the market. After years of owning them, their superior quality and reliability have me refusing to buy anything else. I believe Apple will continue producing high quality products.

Conclusion

Overall, this company enjoys high returns and appears to be a long-term compounder. Normally, I would consider a 3 trillion-dollar company already too far into its business life cycle to be investible. However, Apple has a culture of innovation and a history of branching into emerging markets. Even if augmented reality fails to catch on in the same way smartphones did, I have confidence that they will continue exploring new opportunities as they emerge.

Because of their present valuation, anyone wanting to enter a new position in AAPL should consider dollar cost averaging while buying even more heavily during periods of lower valuation. With a company as attractive as Apple, significant dips should not be a cause for panic, they should be seen as buying opportunities.