Hiroshi Watanabe

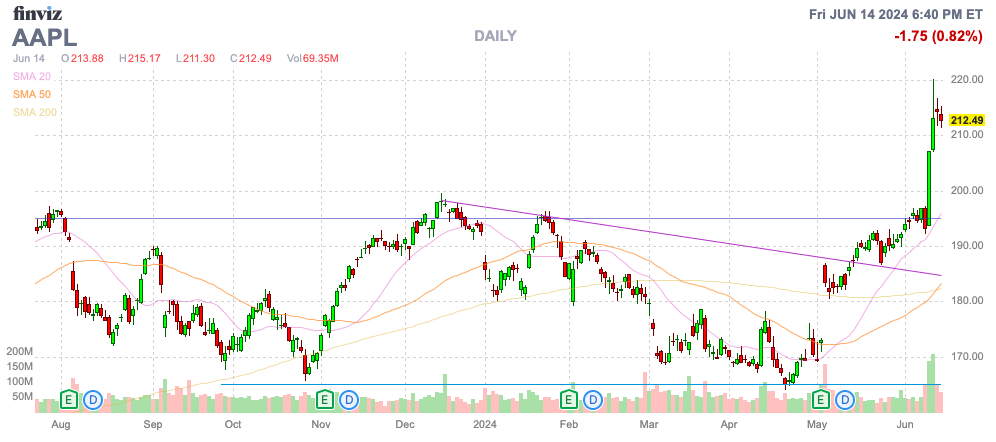

While the stock market was hyped about the AI portion of the annual WWDC, Apple (NASDAQ:AAPL) failed to deliver a compelling product. The stock quickly jumped to all-time highs, though the tech giant isn’t even releasing a killer AI app. My investment thesis remains ultra-Bearish on the stock hitting all-time highs without any justification for the current stock price, much less higher prices.

Source: Finviz

Unintelligent Phone

At the WWDC, Apple released new features for the iPhone, iPad and Mac based on AI. A lot of the key components of the service will rely on ChatGPT from OpenAI.

Apple announced the AI service as Apple Intelligence, a personalized intelligence system for the iPhone, iPad and the Mac. The service generally allows for the creation of images and messages along the lines of other generative AI services and will include advanced features to supercharge Siri.

The tech giant is basically playing catch up with the features already available from Google (GOOG, GOOGL) and Microsoft (MSFT), but the service will only be available on the iPhone 15 Pro and 15 Pro Max and other devices with an M1 or later chip when the iOS 18 is rolled out. In essence, Apple is still behind the competition for several more months and most consumers will need to buy new products in order to use the new AI features.

The company doesn’t appear to provide any monetization of the AI features outside of upgrading devices with Apple’s control of the ecosystem as the only major advantage. The company is working with OpenAI to incorporate ChatGPT into Apple products at no cost with the apparent hopes of ultimately sharing subscription revenues with the chatbot service that charges $20/month to subscribers.

The big catch is that Apple currently collects up to $20 billion from Google as the default search engine. Any shift towards users utilizing AI features to supplant search could actually lead to a reduction in Service revenues, though Apple is also working with Google’s Gemini in a possible deal where Google might provide payments due to the ability to monetize traffic via search features.

No matter how one slices the numbers, the AI iPhone doesn’t lead to material growth rates for the tech giant. The new AI features will generally only apply to the iPhone 16 being released in September, pushing any revenue contribution to FY26.

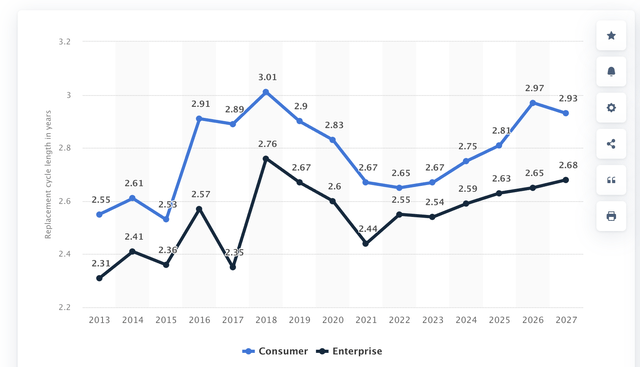

The market is making a big deal about the iPhone upgrade cycle. For years, the cycle has been extending far beyond the original 2-year upgrade cycle based on the incentives from wireless carriers.

The higher ASPs and improved technology have limited the need and desire of users to upgrade iPhones with the typical replacement cycle up to nearly 3 years now with a lot of people holding smartphones for more than 4 years. According to Statista, the smartphone replacement cycle peaked at 3.01 years in 2018 prior to Covid and the 5G iPhone in 2020 reduced the rates temporarily.

The replacement cycle is back at nearly 3 years for consumers heading into the release of the AI iPhone. A big key to this cycle is understanding that Covid won’t provide the extra kicker and any cycle boost is only a one-time event.

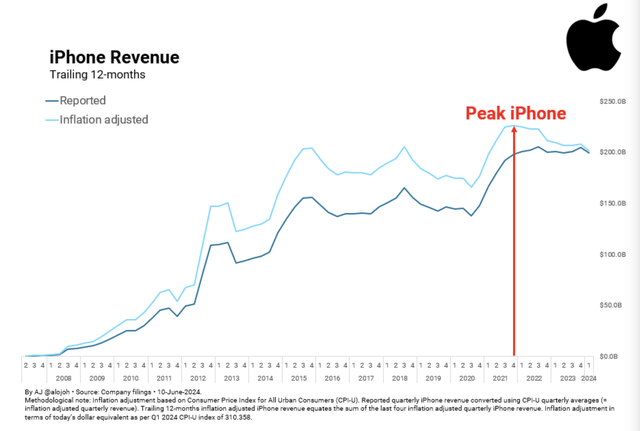

On an inflation adjusted basis, Apple revenues already peaked back at the end of 2021. In fact, iPhone revenues haven’t grown much going back to 2015 despite new features and advanced 5G speeds, likely due to in part to higher ASPs reducing the desire to replace a functioning smartphone.

Mental Gymnastics

After about a week of time to update estimates, analysts still only forecast Apple to produce roughly 6% revenue growth and 10% EPS growth in FY26. Remember, this comes after a long period of limited to negative growth, providing for very easy comps.

Gene Munster from Deepwater Asset Management provides an example of where the stock sees upside. His estimates see Apple revenues for FY26 jumping from a street estimate of 6% to 12% based on higher iPhone sales with an additional target of 10% in FY25 from street estimates of 6%:

Apple Intelligence will not be a new revenue leg like the iPad or Services was, but it will be an accelerator for iPhone and total revenue growth over the next several years, which will be beneficial for shares of AAPL. I expect iPhone sales growth to reaccelerate in FY24 to 5%, compared to being down on average 2% over the past year and a half, and growing 7% in FY25 and 10% in FY26. That means that overall growth goes from about 5% in FY24, to +10% in FY25 and 12-14% in FY26.

In terms of Apple’s valuation, investors are likely now expecting the company to earn around $9 in EPS in CY26 (Street is at $7.90). If we’re entering a 3-5 year AI bull market, it’s reasonable to expect multiple expansion. Investors are zeroing in on a 35x earnings multiple next year, Apple currently trades at 29x next year’s earnings.

The key to the story is that Deepwater is forecasting a multiple expansion to 35x forward EPS targets versus the current 29x targets. In essence, Munster is predicting multiple expansion and not Apple growing sales and earnings to drive the stock higher. After all, the clear driver of growth isn’t a new revenue leg, but just an accelerator for iPhone replacement sales debunked above.

The stock has already hit an all-time high at $220 with Apple trading at nearly 30x EPS forecasts ending the week at $212. Even the ultra-bullish Mr. Munster, well respected on Wall Street, doesn’t make a case for the stock trading at the current price, much less a much higher price to hit his $315 target for 35x a $9 EPS target.

Remember, the above analysis very much questions whether consumers really well lineup to buy a new AI device just due to the AI features, mostly already available via other sources. Analysts don’t agree with the $9 EPS target with FY25 EPS estimates at only $7.22. Even the FY26 EPS target is only $7.96.

As highlighted in prior research, Apple isn’t producing the type of growth to warrant much more than a 15x P/E multiple. Even going out 2 years to use the nearly $8 EPS target for FY26, the price target of the tech giant is only around $120 based on actual numbers.

The AI cycle could definitely provide some upside to analyst estimates, but the history of Apple really isn’t supportive of this case. Apple blew away numbers during the Covid years, but the tech giant had limited growth outside this period, and my famous “Dead Money” article from 2 years ago highlighted a FY25 EPS target of $7.32 and the current estimates have actually fallen during the nearly 2-year period since this call.

The only major difference is the stock price has jumped nearly $50 during the period due to analysts and investors incorporating mental gymnastics to warrant higher stock prices. The true value of the earnings stream of Apple hasn’t changed one bit in the last 2 years, and the company has already cancelled the Apple Car project and the Vision Pro device has failed to deliver material sales.

Takeaway

The key investor takeaway is that Apple hasn’t actually delivered a compelling AI platform, contrary to initial stock momentum. The Apple Intelligence product will fail to deliver anything other than a copy of features delivered by actual AI leaders over the prior 2 years, and the tech giant really doesn’t have any plan to monetize AI, which is why most analysts have hiked revenue and earnings estimates.

Investors should use what appears a peak in the stock price to exit Apple at gift prices.