Wirestock

As measured by market capitalization, there is no denying that technology giant Apple Inc. (NASDAQ:AAPL) is the largest company on the planet. Its value as of this writing is $2.98 trillion. To put this in another perspective, the company’s market capitalization, if it were equated to GDP, would make it the 8th largest country on the planet, just behind France and right ahead of Italy based on 2023 estimates provided by the IMF. This is remarkable, especially considering that 2023 ended up being a bit of a weak year for the firm from a fundamental perspective. But with a robust balance sheet and tremendous amounts of cash flow, the stock has been continually rewarded, with shares hitting an all-time high this year. In the near term, I would make the case that the company is most certainly fairly valued. This is especially true when you consider some of the weak spots it is dealing with. But in the long run, I suspect that shares will continue to do just fine as management plows cash back into shareholders’ pockets and benefits from a strong market position.

Recent strengths and weaknesses

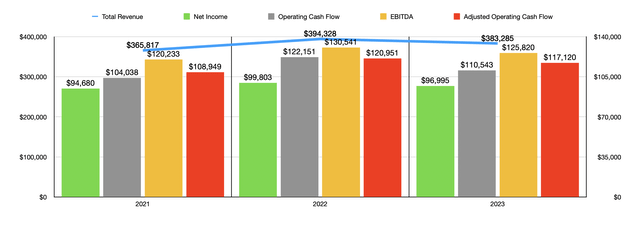

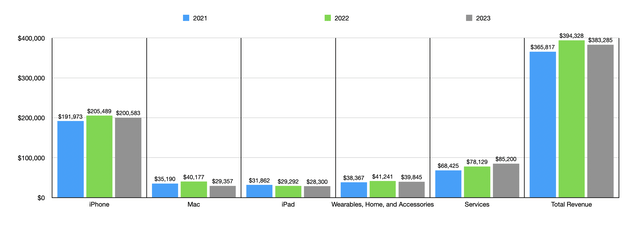

Comparatively speaking, the 2023 fiscal year was not the best for Apple. On both the top and bottom lines, the company underperformed what it was able to achieve in 2022. But that’s not to say that the year was bad. Revenue still came in at $383.29 billion. That’s up from the $365.82 billion generated two years earlier, but it does pale in comparison to the $394.33 billion generated in 2022. It might be helpful to understand that while revenue was weaker as a whole, not everything about 2023 was negative for the company. But to understand where the strengths are and where the weaknesses lie, we do need to dig a bit deeper.

Although management has long since discontinued the reporting of individual unit sales, they do still provide aggregate revenue figures for different product categories. The largest portion of the company, for instance, remains its iPhone operations, accounting for $200.58 billion, or 52.3%, of overall revenue for 2023. This was one of the weak spots for the company, however, for the year. I say this because revenue in 2022 for iPhone products was $205.49 billion. In fact, almost every portion of the company showed weakness year over year in 2023. iPad sales, for starters, came in 3.4% lower than they were the year prior. Wearables, Home and Accessories revenue dropped 3.4% as well. But the real pain came from Mac products, with revenue plunging 26.9% from $40.18 billion to $29.36 billion.

The management team at Apple attributed this year-over-year weakness to COVID-19 related supply constraints in the third quarter of 2022 that ultimately resulted in a surge in demand in the final quarter of last year. While there might be some truth to that, the numbers don’t add up. You would expect to see some weakness in demand at some point prior to this if supply constraints were truly a problem that resulted in pent-up demand. But you really don’t. In 2021, for instance, Mac revenue totaled $35.19 billion. And in the year prior to that, it was $28.66 billion. We don’t really see a decline of a substantive nature until this year.

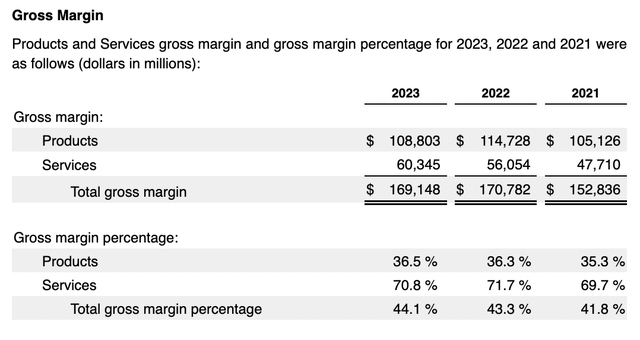

Regardless of that weakness, there was one area in which the company thrived. And this involves the Services category that is made up of advertising revenue, AppleCare revenue, cloud services revenue, the sale of various digital content, and payment services such as those involving Apple Card and Apple Pay. The company’s products Are valuable because they bring in high amounts of revenue. But services can be viewed as the company’s ability to entrench itself into the lives of its customers. Once you become attached to a service or suite of services, it creates stickiness with the brand. Furthermore, services always have higher margins than products do. As an example, we need only look at the image below covering the past three years. The gross profit margin of the company’s services far outpaces the gross profit margins associated with the products that it sells.

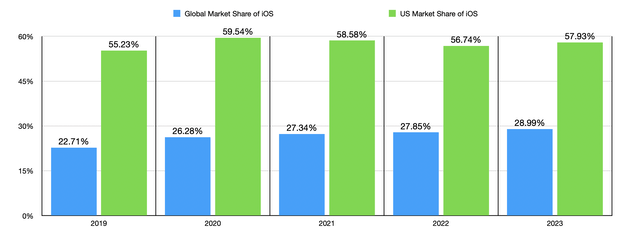

The fact that services continue to grow is a massive positive for shareholders. It’s also likely an indication that near-term softness in some or all product categories is a temporary issue. But there is other data that we can look at that shows not only this to be true, but also shows that the long-term outlook for the company is likely positive. As an example, let’s pay attention to the smartphone market share. Globally, Apple does not maintain an industry-leading position. That belongs to the devices that operate collectively on the Android operating system. Having said that, Apple’s market share in recent years has grown. Back in 2019, for instance, it stood at 22.7%. Each year since then, it has increased modestly. And as of 2023, it stands at roughly 29%. Apple products tend to appeal to those who have higher levels of disposable income. And it is undeniable that, as time goes on, the world is becoming wealthier. So those who can realistically afford Apple over the cheaper Android products will continue to gravitate in that direction.

I wish I could say that the same case holds true when it comes to the U.S. market on its own. But over the past five years, Apple’s market share has remained in a fairly narrow range with no real trend. That ranges between 55.2% and 59.5%. In 2023, it was estimated to be 57.9%. In the short term, this is not great to see. But in the long run, I suspect that the business will eventually see its market share expand. I’m not saying this on a whim. Rather, there are other sources out there that have found some interesting bits of information. According to a research report by Bloomberg Intelligence, for instance, it was found that, in the U.S. market, 79% of those who are members of Gen Z had a preference for the iPhone compared to the 41% of that generation that own significantly into one. If this preference holds true, as Gen Z comes of age and becomes wealthier, the company forecasted that Apple’s installed base could grow by around 7% per year. A separate report by Piper Sandler surveyed over 9,000 teenagers and found that 87% claimed to own an iPhone, with 88% saying that they expect their next phone to be an iPhone.

When you consider that Gen Z is the second-largest generation by population right now at 69.58 million, just behind the 72.24 million iPhone-friendly Millennials, that picture bodes well for shareholders of Apple. While the US is the most important market for Apple since it accounts for 42.4% of the company’s revenue and 40.1% of its operating profits, there are other countries where a similar trend exists. In South Korea, for instance, only 23% of smartphone users have iPhones. But 65% of those aged 18 to 29 there, as well as 41% aged 30 to 39, have a preference for iPhones. Other countries with significant levels of iPhone adoption include Switzerland, Denmark, Japan, Macau, Australia, and others.

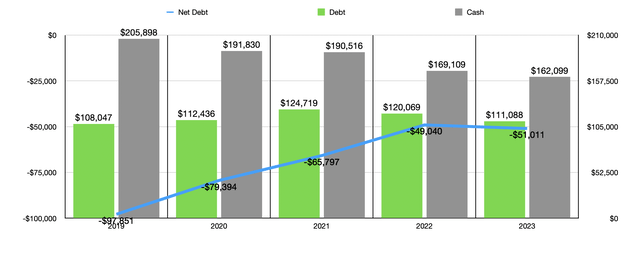

Outside the longer-term picture, there are some good reasons to like Apple as a prospect. Even though the company has experienced some weakness in 2023, it still remains a cash cow that is rewarding shareholders significantly. Over the past five years, the firm has seen its adjusted operating cash flow, which is operating cash flow without factoring in changes in working capital, expand from $72.88 billion to $117.12 billion. While management invests significantly in the firm’s growth initiatives, the firm also uses its capital to reward shareholders significantly. Over the past five years, the company has allocated $392.18 billion to share buybacks and another $72.53 billion to dividends. This has not come without a cost though. Over that same window of time, the amount of cash and cash equivalents that the company had that exceeded debt shrank from $97.85 billion to $51.01 billion. To be fair, that probably is enough cash to have on hand. If anything, it wouldn’t be surprising if this number were lower. It just goes to illustrate, however, how dedicated the company is to returning its capital to its investors.

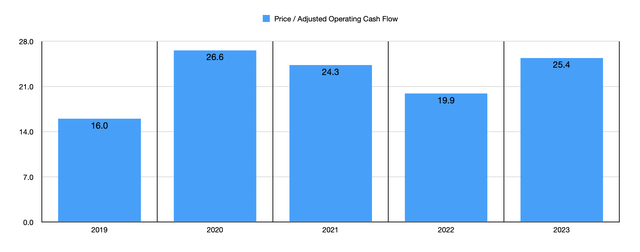

If I were to look at the picture through a 10 or 15-year time horizon, I would make a guess that Apple will be larger and more profitable at the end of that horizon than it is today. Possibly significantly so. Those who buy into the stock with that kind of time horizon probably will do just fine, though whether or not they will match or exceed the market’s return is a different story entirely. I would argue that they probably won’t. Part of this is because it is difficult for massive corporations to grow, especially when we are talking about organic growth. But the other part relates to how shares are priced at this time. In the chart below, you can see the price-to-adjusted operating cash flow multiple of the company over the past five years. The stock is not overvalued based on historical levels. But it is in a range that I would consider to be more or less fairly valued for a high-quality cash cow.

Takeaway

Operationally speaking, Apple is doing just fine for itself. We have seen some weakness for 2023. But when we start focusing on the longer-term picture, I suspect that further growth lies ahead. This does not necessarily mean that the company makes for a compelling investment opportunity. At this time, I would argue that shares are a bit lofty. Because of this, I’ve decided to rate the business a ‘hold’. But for those who have a 10 and 15-year investment horizon and who don’t mind taking a substantial risk that they would generate positive returns but underperform the broader market, I can understand why an investment in the firm might make sense.