Bogdan Khmelnytskyi

We remain hold-rated on Apple Inc. (NASDAQ:AAPL) post fiscal Q4 2023 earnings results yesterday. We expect the current macro headwinds to continue weighing on end demand and see a limited upside to the company’s financial outperformance in the back end of the year and into calendar 1H24. Management now guides for $117B in sales for its December quarter, representing a flat Y/Y growth in line with consensus. While we think the outlook prices in the slower end demand rebound, we don’t see any near-term catalyst offsetting the macro headwinds.

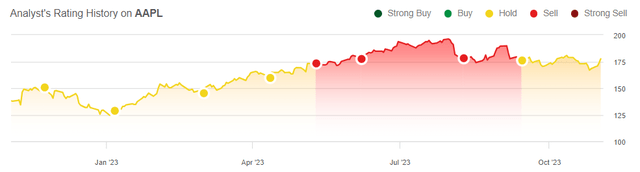

The following chart outlines our rating history on Apple.

We think the strength of the USD and heightened competition in the smartphone market after Huawei’s launch of Mate 60 Pro will add more negative impact to international sales and see limited room for iPhone sales acceleration in its supply chain. Huawei’s re-entering the smartphone market this year, coupled with the nationalist sentiment from China as U.S.-Chinese tensions escalate, will weigh on iPhone growth, in our opinion. This quarter, the company saw relatively flat Y/Y growth in its China market sales, and we think this is in part due to the competitive environment and geopolitical tensions in the nation.

We are seeing positive signs in iPhone sales reacceleration after the 2% Y/Y drop last year, with sales declining 1% Y/Y in Q4 2023. We’re less optimistic, however, about iPhone sales, meaningfully accelerating in the near-term. Aside from the increased competition and still lackluster end demand, we think the iPhone 15 lacks innovation. We believe the lack of innovation will materialize in fewer customers opting to upgrade their current devices amid the challenging macro backdrop. The new iPhone 15 sales are expected to grow Y/Y in the December quarter, but we don’t see any material acceleration in its supply chain. We believe iPhone sales will be mix-driven rather than unit-driven, which hasn’t previously been the case for Apple. Additionally, we expect the strength of the U.S. dollar will likely impact the lower-end range of the iPhone line.

Pressure continues on iPad & Wearables

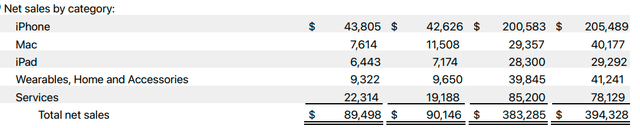

Product revenue dropped 5% this quarter to $67.2B versus a 4% Y/Y decline last quarter to $60.6B, largely due to the challenging market for Mac and iPad sales. While the Mac sales are expected to accelerate Y/Y in the December quarter due to the new M3-based products launch, we’re concerned that sales of iPad and wearables are expected to decelerate meaningfully Y/Y. We estimate the PC market to rebound in 2024 with a PC TAM of 5-8% Y/Y growth and see an improved end demand for Mac sales. We cannot say the same for iPads and Wearables, both of which declined Y/Y this quarter by 10% and 3%, respectively, to $6.4B and $9.3B. iPad sales’ Y/Y decline contracted sequentially from a 20% Y/Y drop last quarter, while Wearables sales were up 2% Y/Y in 3Q23 and dropped Y/Y this quarter. Consistent with management’s expectations, we see iPad and wearable sales continuing to be in the negative range for Y/Y growth in the December quarter and see this weighing on top-line growth.

The following table outlines Apple’s net sales by category this quarter.

Valuation

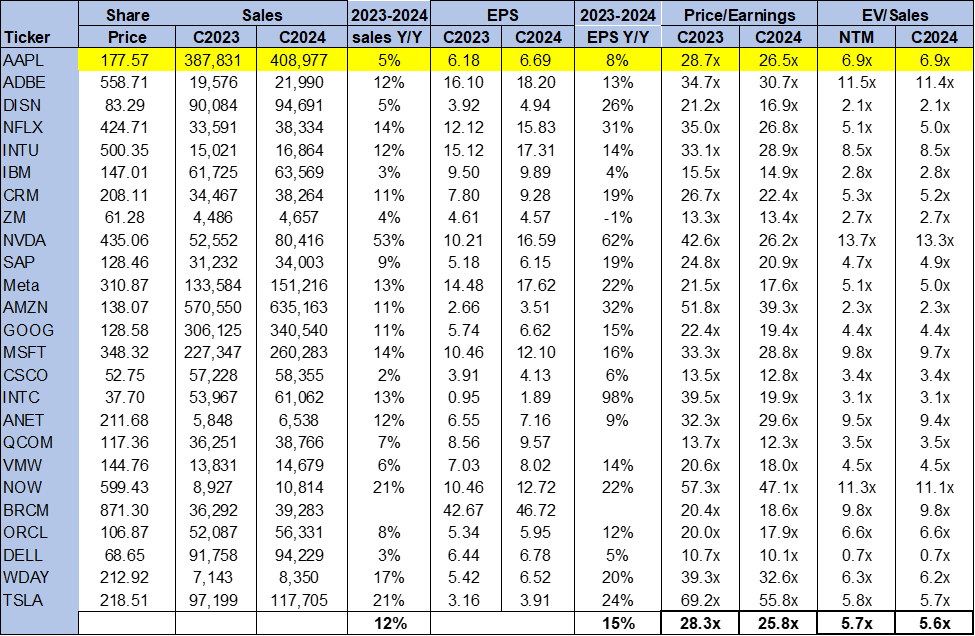

The stock is trading above the peer group average; we think the higher multiple coupled with the near-term headwinds does not make for an attractive risk-reward profile in 2H23. On a P/E basis, the stock is trading at 26.5x C2024 EPS $6.69 compared to the peer group average of 25.8x. The stock is trading at 6.9x EV/C2024 Sales versus the peer group average of 5.6x. We understand Apple’s status in the smartphone market gives it more room for higher valuation. Still, we don’t see the stock outperforming materially in the near term and hence recommend investors stay on the sidelines in 2H23.

The following chart outlines Apple’s valuation against the peer group average.

TSP

Word on Wall Street

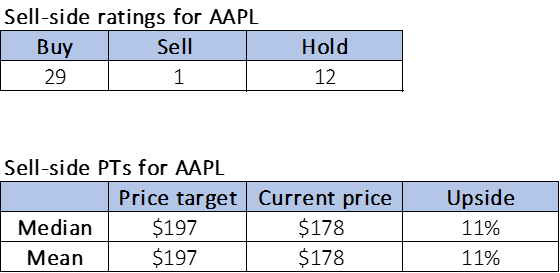

Wall Street doesn’t share our bearish sentiment on the stock. Of the 42 analysts covering the stock, 29 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment to the stock’s longer-term outlook once PC and smartphone end demand recovers towards 2H24. We think investors are better suited to wait for more attractive entry points down the line, as we believe material financial outperformance will be delayed towards 2024.

The stock is currently priced at $178 per share. The median and mean sell-side price target is $197, with a potential upside of 11%. The following charts outline Apple’s sell-side ratings and price-targets.

TSP

What to do with the stock

We continue to be hold-rated on Apple Inc. stock; while we think the company is a well-oiled tech hardware icon, it’s not immune to macro headwinds. We see limited near-term upside to its financial performance in 2H23 as guidance remains flat Y/Y, and iPhone sales’ rebound is expected to be more gradual. Additionally, we think the macro backdrop pertaining to USD strength and increased competition in the smartphone market will negatively impact sales, particularly in emerging markets. We recommend investors stay on the sidelines in the near term.