Lobro78

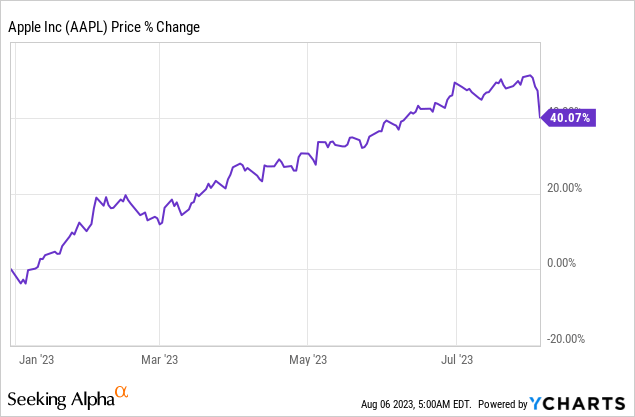

Apple (NASDAQ:AAPL) reported earnings coming in above expectations for its third fiscal quarter last week, but shares of the technology firm fell 4.8% nonetheless as investors feared continued business headwinds for Apple’s hardware categories. Apple also reported its third consecutive quarter of top line declines due to weakness in iPhones, Mac and iPad… all of which saw revenue drop-offs compared to the year-earlier period.

The PC market, however, is showing signs of stabilization, which is the main reason for my rating upgrade to hold (I previously rated Apple a sell due to its hardware reliance and weak PC market). Considering that Apple still has uncertainty regarding the release of its newest iPhone and that shares are still trading above their 1-year average P/E ratio, I would wait for a larger correction before engaging!

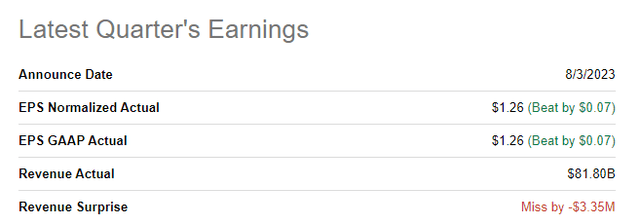

Apple beat consensus EPS estimates, but revenue slowdown in hardware is a concern

Apple reported revenues for its third fiscal quarter of $81.80B (in-line) and earnings of $1.26 per-share, which beat the consensus analyst estimate by $0.07 per-share. Although Apple beat earnings, the company experiences top line challenges in the near term that I expect to continue to weigh on Apple’s valuation factor.

Source: Seeking Alpha

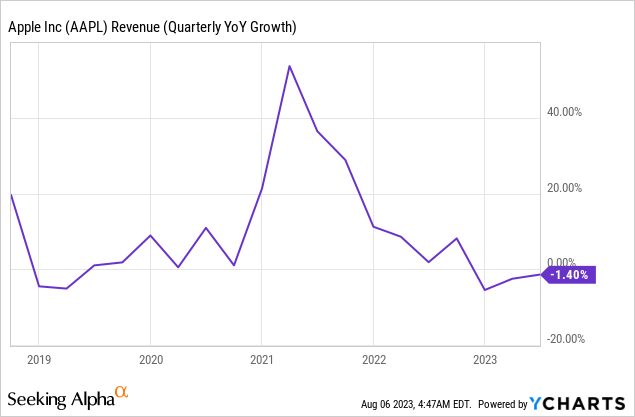

Apple reported its third consecutive quarter of revenue declines and the technology company saw a top line decrease in three out of five segments in the third fiscal quarter: Apple’s FQ3’23 iPhone revenues were $39.67B (down 2% Y/Y), Mac revenues hit $6.84B (down 7% Y/Y) and iPad revenues were $5.79B (down 20% Y/Y). Weak hardware sales were largely expected as the device market remained highly challenged in the second-quarter.

Due to the deterioration of fundamentals in the device market, Apple has seen a steep drop-off in top line growth: in FQ3’23, Apple saw its revenue base contract 1.4%.

Signs of device market stabilization

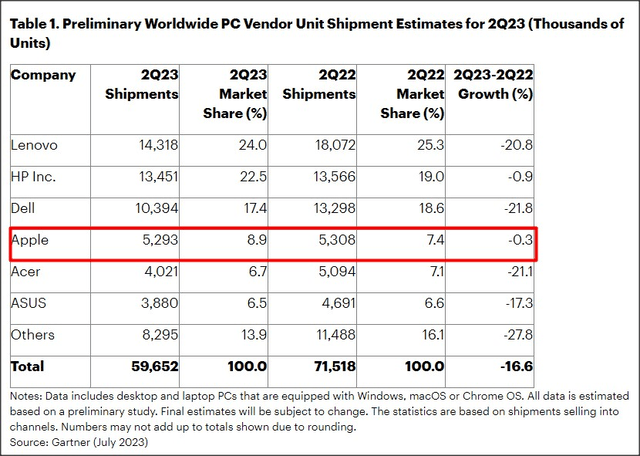

According to consulting and research firm Gartner, global PC shipments declined 16.6% in the second-quarter as the market is still working through inventory issues and consumers seem not yet ready to upgrade their IT equipment. Consumers already upgraded their IT equipment during the pandemic in order to prepare for remote working and learning, which is why the PC market has seen a steep correction in the last few quarters.

However, the situation is showing signs of stabilization as the downturn in the device market slowed in the second-quarter. In the first-quarter, the industry saw a 30% decline in global PC shipments. According to Gartner, Apple did relatively well compared to the drop-off rates of other vendors, many of which saw a volume contraction of more than 20% compared to the year-earlier period.

Source: Gartner

Besides an improving situation in the device market, Apple faces a potential catalyst (positive or negative) next month when it is expected that the technology company will release its latest blockbuster product, the iPhone 15. The iPhone has apparently run into some production issues which could delay the availability of Apple’s iPhones. However, the release of the new iPhone is set to lead to a new upgrade cycle and will most likely reinvigorate Apple’s iPhone revenue growth.

Source: Phone Arena

Services revenue reaches all-time record

The weakness in hardware sales has been offset once again by strength in Apple’s Services business, which includes the company’s advertising sales as well as other products such as Apple Music, TV+, iCloud, AppleCare, Apple Pay etc.

Apple’s Services segment generated $21.21B in revenues, showing 8% year-over-year growth in FQ3’23, in part due to an improving advertising landscape. Services reached an all-time revenue record, and the business is becoming more important for Apple as a driver of revenue growth. Services revenue represented 26% of Apple’s total revenues in the last quarter, compared to a 22% revenue share in FQ2’23. If current trends continue — slowing hardware and robust services revenue growth — then Apple could achieve about a third of its consolidated revenues from non-hardware related products by the end of next year.

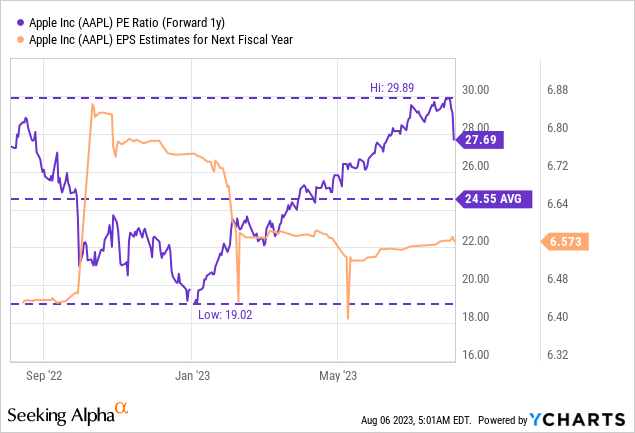

Apple’s valuation: don’t buy the dip just yet

Shares of Apple dipped 5% after the company released earnings for its third fiscal quarter. I believe Apple’s shares are still a little bit on the expensive side here, with a P/E ratio of 27.7X. The technology company is expected to generate $6.57 per-share in earnings next year, implying 9% Y/Y growth. However, shares keep trading 13% above the 1-year average P/E ratio. I would wait for shares to drop at least to the average P/E ratio (implying a price level of ~$160) before engaging here. There is also a risk that uncertainty around iPhone 15 availability will depress Apple’s share price for a while longer, potentially offering investors a better opportunity in the weeks ahead.

Risks with Apple

The main risk that I see with Apple relates to its consumer-focused business model, which results in Apple being highly dependent on consumer spending as well as the health of the overall device market. While the PC market has shown signs of stabilization in the second-quarter, there is no guarantee that we have already seen the bottom. A down-turn in the PC market as well as a delay in iPhone 15 availability are risks that could heavily influence Apple’s valuation factor going forward.

Closing thoughts

Apple’s third fiscal quarter earnings report was a mixed bag and included a bottom line beat, a sequential revenue drop (the third consecutive one) and a continuation of the trend that we have seen in previous quarters: Services growth offsetting slowing/falling growth in hardware categories. Given the state of the PC market, I believe Apple executed fairly well in the second-quarter. However, there is some uncertainty surrounding the launch and the availability of the new iPhone 15, expected for September, which I believe could weigh on investor sentiment for a while longer. Since Apple’s shares are still trading above their 1-year average P/E ratio, investors may want to wait until a bottom has emerged before engaging!